Much hay has been made about how the Inflation Reduction Act represents America’s biggest climate investment ever. But reading between the lines of the legislation, which tackles everything from taxes to health care, shows that the nearly $740 billion law has some caveats, including new provisions to a more than decade-old EV tax credit.

For years, prospective electric vehicle buyers could count on a federal vehicle tax credit, which amounts to a $7,500 discount on a wide range of EV models. The incentive was originally authorized in 2008 and played a critical part in promoting early EV startups and encouraging price-conscious consumers to take the plunge and go electric. The IRA extends the tax credit until 2032 and establishes an additional $4,000 credit for used EVs.

final assembly of any qualified vehicles must take place in North America, and the credit will also hinge on the vehicle’s size, its total cost, and potential buyers’ income. Starting before 2024, at least 40 percent of the critical minerals and at least half of the battery components used to build new eligible EVs will need to come from the US or one of its free trade partners to access the full credit.

But for most consumers, the new tax credit could prove elusive. Around 70 percent of the electric, hydrogen, and hybrid cars currently sold in the US won’t be eligible for the credit, according to the Alliance of Automotive Innovation, a trade group that represents the car industry. An August analysis of the IRA proposal from the Congressional Budget Office estimates that only about 11,000 vehicles could receive the credit in 2023, and around 60,000 vehicles in 2024, according to an August analysis of the IRA proposal. While the Internal Revenue Service is charged with determining which vehicles are eligible, experts told Recode that they expect very few cars to receive the credit over the next several years, especially since the law’s sourcing requirements are designed to become more stringent.

But that may not be the case forever. The tax credit is only one part of the Biden administration’s plan for a new era of American auto manufacturing, which includes everything from a new push to rethink mining regulations to the Bipartisan Infrastructure Act’s $3 billion investment in the domestic battery supply chain. Together, these efforts, and a surge in new EV factories based in the US, could make American-made electric vehicles much more common in the latter part of the decade. At the same time, this credit won’t necessarily disincentivize people from buying EVs that are made abroad, especially as electric vehicle prices decline and as geopolitics continue to complicate the world’s access to fossil fuels.

“People will still go ahead and purchase EVs that do not qualify for the tax credit,” explains Jane Nakano, a senior fellow at the Center for Strategic and International Studies’ energy security and climate change program. “EVs do have some real consumer benefits. It’s not just for decarbonization. It’s household economic benefits, and then to some extent, energy security benefits.”

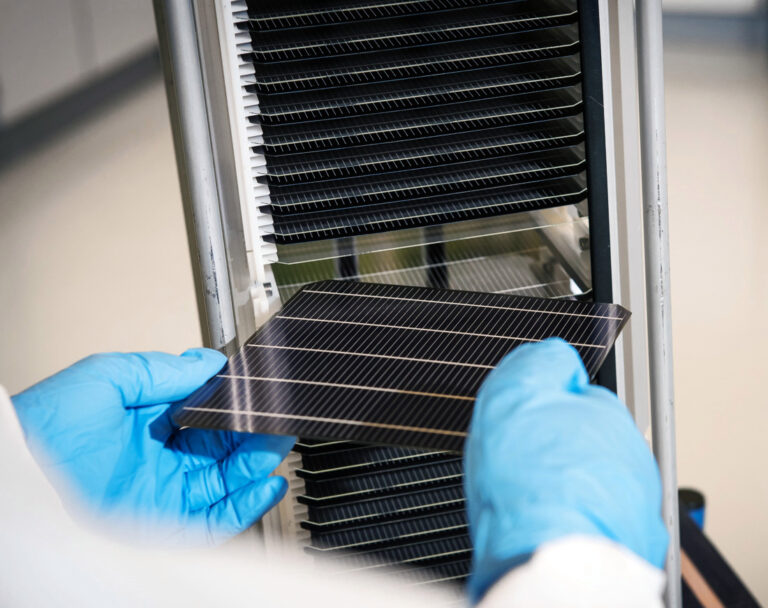

Right now, China is the undisputed world leader in EVs. Though the critical minerals used in electric vehicle batteries are currently sourced from all over the world –– the lion’s share of cobalt comes from the Democratic Republic of the Congo, while lithium tends to come from South America and Australia — much of the processing of those materials takes place in China. China is also responsible for more than 70 percent of global battery cell production. The country not only makes much of the world’s battery components, like cathode materials, but is also home to the largest battery manufacturer, Contemporary Amperex Technology Co.

The overhauled vehicle tax credit aims to catch up and compete by putting increasing pressure on automakers, though they do get one major piece of help. The earlier version of the credit included a provision that after an automaker made 200,000 eligible vehicles, people could no longer claim the $7,500 credit. That means companies like Tesla and GM haven’t been able to offer the credit for some time. The latest version of the law eliminates that limitation, so car models built by larger EV manufacturers could become eligible for the credit once again.

Car manufacturers will face an uphill battle in meeting those requirements, especially since the percentage of components and materials that must come from the US or its partners is designed to increase in the coming years. US reserves of minerals like cobalt, lithium, and nickel are just a small fraction of the world’s current supply. Even stricter rules will eventually kick in: By 2024, eligible vehicles can’t incorporate any battery components from China or other “foreign entities of concern,” and in 2025, they can’t include any critical minerals from these countries, either.

“This is the very moment for those automakers to decide the next pathway of their business model and where they’re going to invest and shore up their production,” explains Katherine Stainken, the vice president of policy at the Electrification Coalition, an organization that promotes EV adoption.

The US was making progress on this front even before Biden signed the IRA earlier this month. Automakers and electronics manufacturers have been slowly adding to the number of battery production facilities in the US over the past several years. Earlier this week, Honda and LG Energy Solution announced that they would build a $4 billion battery plant in the US, with mass production expected in 2025. Panasonic, which said it would open a battery factory in Kansas last month, now says it may build a second facility in Oklahoma. The Department of Energy estimated at the end of last year that at least 13 new gigafactories may be coming to the US, joining the several plants that companies like Tesla and GM have already opened.

These efforts are buoyed by the Biden administration’s other investments in the tech supply chain. The White House has already appropriated funding from last year’s Bipartisan Infrastructure Act to support new projects focused on lithium production and critical mineral recycling, and the Department of Energy is loaning out billions to support the construction of new GM and LG Chem battery factories. The White House is also supporting an effort in Congress to overhaul the Mining Law of 1872, which still governs much of the mining within the US today. Biden declared the key metals used in EVs critical to national security when he invoked the Defense Production Act in April, setting the groundwork for the Department of Defense to boost the domestic mining industry.

The CHIPS and Science Act could give American-made EVs a lift, too. The $52 billion package subsidy, which Biden formally approved earlier this summer, will subsidize the construction of several new semiconductor factories in the US, including plants focused on making automotive chips. This is especially important for EVs, which can easily require double the number of computer chips that comparable internal combustion vehicles do.

“What the United States is doing right now is securing its own supply over the next 10 years,” explains Nathan Iyer, a senior associate at RMI, “and making sure that what currently is 0.7 percent of the global market goes up to a more reasonable amount, closer to 5, 6, 10, 13 percent of the global market, to really ensure that our own demand is being covered by supply chains.”

Biden’s plan does have some real flaws, however. Federal mining applications and approvals have decreased over the past several years, and environmental regulations may stall the opening of new mining projects Critically, the prospect of building or expanding new mines introduced the risk of pollution, potential damage to agriculture and wildlife, and disproportionate impacts on local communities. In Minnesota, members of tribes who live nearby are already raising concerns about a mine from which Talon Metals, a company that has won a contract with Tesla and praise from the Biden administration, is planning to extract nickel for EVs.

There are logistical hurdles as well. The IRS needs to figure out how to accurately determine which EV models meet the new credit’s tough sourcing requirements, a task the tax agency is not currently equipped for. Other countries, including the European Union and South Korea, have suggested that the clean vehicle tax credit may be unfair to foreign carmakers and could violate international trade rules. It’s also possible that automakers will accept a $7,500 markup to avoid the government’s new requirements entirely.

These efforts are a reminder that even though the US has a long history of building cars, the country is mostly starting from scratch when it comes to electric vehicles. The investments the Biden administration is making in EV manufacturing capabilities largely won’t produce components or vehicles for at least several years, which means consumers may have to wait to reap the full benefits of the extended credit. Only time will tell whether Biden’s dreams for an EV renaissance for the American auto industry ultimately pan out.

This story was first published in the Recode newsletter. Sign up here so you don’t miss the next one!