Meta, the parent company of Facebook, needs to stay relevant. While it boasts over 3.5 billion users a month across its Facebook, Instagram, and WhatsApp platforms, its user base is aging, it’s facing fierce competition from the short-form video platform TikTok, and its ad-targeting business model is confronting a painful disruption. What it focuses on next will determine its future and have an impact on the many people who rely on its products.

Meta CEO Mark Zuckerberg has made the company’s long-term plan clear: It’s all-in on the metaverse, a virtual world where people can use augmented and virtual reality tech to interact with each other. But the metaverse for now is mostly a concept and will take five to 10 years to build. (To put that in context, Meta was founded only 18 years ago.) In the meantime, Meta is putting its full force behind Reels, a short-form video product that looks a lot like TikTok and has gotten a lot less buzz than its big metaverse bet. That doesn’t mean Reels should be overlooked.

On a recent earnings call, Zuckerberg mentioned Reels at least 20 times and listed it as his top key investment area for 2022, saying, “It’s definitely the right thing to lean into this and to push hard to grow Reels as quickly as possible and not hold on the brakes at all.”

So far, Meta’s push for Reels seems to be working, at least in terms of grabbing Facebook users’ attention: According to an exclusive analysis provided to Recode by the social internet think tank the Integrity Institute, Reels has become so popular that more than half of the top 20 most-viewed posts across Facebook (the report does not include Instagram views) in the US last quarter were Reels that were originally posted to Instagram. Last quarter was the first that Reels have been on Facebook, so it makes sense that Reels are appearing for the first time on these charts, but it’s a big deal that they’re taking up this many of the highest-ranked posts. Still, there’s a caveat: A majority of most-viewed Reels were shared by accounts that are anonymous or primarily aggregate and repost other creators’ content, like TikTok videos.

That finding reflects a broader weakness of some Reels videos: They aren’t unique. And while Facebook is pushing creators to make more fresh content, that doesn’t always result in better videos.

Still, the early popularity of Reels shows that when a company of Meta’s size wants the almost 4 billion people using its products to embrace something (regardless of its quality), it’s hard to resist. The initial success also suggests Reels is poised to do the same thing past Meta products — including copycat features like Instagram Stories, which were clearly inspired by Snapchat — have done: reshape how billions of people communicate and share information, and help Meta remain the biggest social media company in the world.

“Reels is part of a broader industry arc toward short-form video,” Meta’s director of product for Reels, Tessa Lyons-Laing, told Recode. The feature “is absolutely a core part of our young adult strategy,” Lyons-Laing said. “It’s one that we’re going to continue to invest in for that reason.”

Early Reels successes and challenges

In years past, Facebook has pivoted toward — and then away from — promoting video posts over text and images on people’s feeds. But since Reels launched on Instagram in August 2020 and on Facebook in September 2021, the company is once again pushing toward video, and that’s already had a significant impact on the kind of content that’s most popular on the app.

Meta recently announced that Reels is the “fastest-growing content format” on Facebook and Instagram — meaning that it’s growing more quickly than older features like Stories, Watch, and feed posts. The company says Reels is also now the biggest contributor to engagement growth on Instagram — meaning it is where people’s likes, comments, and shares are increasing the most. That’s in part because Instagram has been suggesting Reels in people’s feeds — raising the question of whether people are viewing Reels because they like them or because Facebook is serving Reels to them.

But the feature isn’t just growing quickly: As the Integrity Institute’s analysis shows, Reels has begun overtaking other formats. Reels represented 11 out of 20 of Facebook’s most viewed posts in the last quarter of 2021.

The analysis also offered insights into what kind of Reels are getting the most play: about 73 percent of the most-viewed Reels on the top 20 chart were posted from anonymous accounts and nearly 82 percent were from accounts that primarily aggregated other people’s content. Two out of the 11 top Reels on the list were actually recycled TikTok videos, according to the report. It’s a small sample size, but it’s still an indication of the kind of Reels that play well on the platform.

Jeff Allen, a former Facebook data scientist and the co-founder of the Integrity Institute, told Recode the high percentage of unoriginal and anonymous content is concerning because it suggests Reels is incentivizing aggregator, spammy accounts, rather than rewarding original creators who spend time and effort to create high-quality videos.

“If you’re a creator, obviously you don’t want unoriginal content on the platform because it’s people stealing your content,” said Allen.

In the long run, that might hinder Meta’s push to get everyone watching more Reels.

In response to the findings, Meta’s Lyons-Laing said the company expected to see more unoriginal content on Reels because the feature is still in its early days.

“As we get better about building the systems to reinforce original content, I think you will see that transition over time,” said Lyons-Laing.

Meta has already started to nudge creators to share Reels made uniquely for Instagram and Facebook: In February 2021, it announced it would deprioritize re-shared TikTok videos imprinted with the TikTok logo. It said it is spending $1 billion in bonuses and other payouts to creators by the end of 2022, and recently started a trial to share 55 percent of ad revenue on Reels to a select group of creators.

“We want to help the people who are creating content [to] make a living; that’s who we’re trying to reward,” said Lyons-Laing. “That’s a key tenet that we’re going to continue to invest in.”

Already, Meta’s nudges are working, convincing some of the creators and influencers who earn a living on its platforms to shift the kind of content they share.

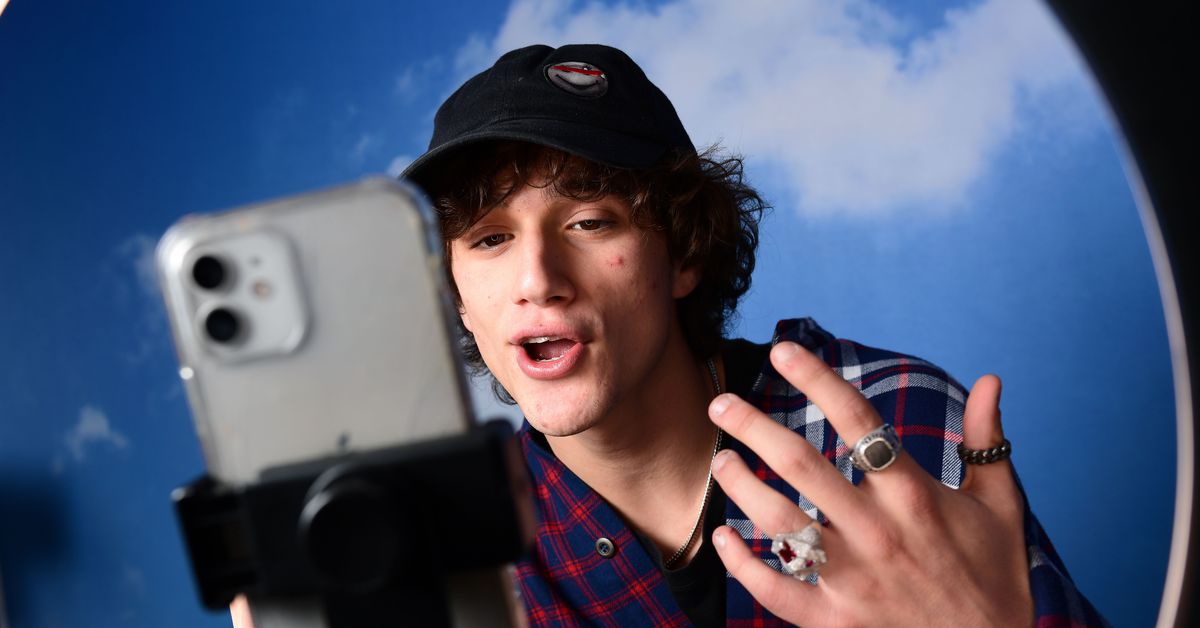

That’s why Erin Sheehan, 24, a New York City-based lifestyle influencer with over 12,000 followers who goes by the handle @girlmeetsnewyorkcity, has shifted her focus from posting photos on Instagram to creating Reels. She was initially hesitant to make videos because they’re more complicated to produce, but she began embracing the format after the company started offering her bonuses based on the number of Reels views she gets.

“Listen, if they pay me, I’ll take it,” said Sheehan, who has seen her Reels views grow in the past year, and now gets more views per average on her Reels than photos. “It’s undeniable now that Reels is the content that is performing the best on Instagram,” she added.

Getting people like Sheehan on board is a key part of Meta’s plan to keep itself dominant. If Meta can successfully convince its vast network of influencers to post Reels instead of the photos they’re more comfortable with, the company might be able to create a new network of Reels-exclusive creators.

But making good content isn’t as easy as simply paying creators. As my colleague Rebecca Jennings wrote this week, some creators are making Reels when they’d prefer to be posting photos or stories instead, resulting in what some find less engrossing content than what you can find on TikTok.

One way Instagram may be able to entice creators other than just paying them: offering consistency.

Some creators who post to both platforms have said they’re getting more consistent likes, shares, and comments on Reels than on TikTok.

“My Instagram Reels engagement is going through the roof,” said Oorbee Roy, a 47-year-old skateboarder and mom who goes by the handle @auntyskates and has over 33,000 followers on Instagram. Roy built her social media following on TikTok but said that recently she’s been posting her content to Reels, where she has a slightly older and more international fan base — particularly in India. India’s government banned TikTok in June 2020, which creates a major opening for Meta to easily hold onto its social media dominance in the country.

In the rest of the world, it’s less clear if Facebook’s push to overtake TikTok as the No. 1 destination for short-form social video will work. TikTok also launched a creator fund of $200 million in 2020, which it plans to expand to $1 billion in the next three years. It’s a competition that will come down to whether or not Facebook and Instagram can promote the kind of captivating content that TikTok has, and whether it can win over a key audience: young adults.

The fight with TikTok for short-form video dominance

The two most important drivers of Meta’s Reels push are connected: The company’s relevance for younger people in the US is fading, just as younger generations are embracing TikTok — which was 2021’s most downloaded app in the world.

Facebook’s younger user bases in the US have declined significantly, with teenage users declining by 13 percent from 2019 to 2021, according to internal documents revealed by Facebook whistleblower Frances Haugen last year. At the same time, the leaked documents showed how Facebook has publicly downplayed its own research that found a connection between its products and mental health issues in some teenagers, including that Instagram made body image issues worse in one out of three teenage girls. This led US regulators to pressure Meta to slow down its efforts to attract the younger users who are critical to its long-term business success.

But the scrutiny doesn’t change the fact that for any social media company, younger users are still the most valuable demographic to have.

“It’s all about the ‘LTV,’ the lifetime value of a given user,” said Mae Karwowski, the CEO and founder of Obviously, a social media influencer marketing firm. “You always need to make sure you’re catering to younger and younger people so that you don’t phase out or become perceived as an app for older people.”

TikTok, meanwhile, has exploded in popularity with teenagers. In the past year, 3 percent of TikTok’s users were 18-25, while only 27 percent and 23 percent of Instagram and Facebook users were in that younger demographic, respectively, according to online measurement company SimilarWeb.

But while TikTok seems to be ahead of Meta when it comes to its younger audience and its sudden cultural impact, that might not be enough. Meta has the power of scale.

“TikTok is a wonderful product and has nailed the short-form video format. It was lightning in a bottle,” Benjamin Black, co-head of US internet equity research at Deutsche Bank, told Recode. “But Meta has a bigger user base, which by definition means more eyeballs. … I think they’re well-positioned to narrow the gap.”

He added that convincing more creators to embrace Reels will be a key part of Meta’s strategy to compete with TikTok.

If history is any indication, remember how quickly Meta’s Instagram copied and then overtook Snapchat, which was a major threat to Facebook back in 2016. Snap is still around, profitable, and popular with younger users — but it’s not seeing the levels of rapid growth and cultural influence some once thought it could grasp, and that TikTok currently has.

It is too soon to say whether the Meta versus TikTok fight over short-form video will pan out the same way the Meta versus Snap situation did. But one thing’s for sure: Reels is here to stay; it’s not just a throwaway copycat feature but a core part of Facebook’s ever-evolving strategy to remain relevant and beat its competition.