Does this sound familiar?

You’ve got tons of traffic, conversion-optimized product pages, and a sleek and seamless checkout process. And yet, your ecommerce conversion rate hovers around 2% to 3% — and that’s considered a good conversion rate.

Why aren’t more of your visitors converting?

For many retailers, it’s not your products, your brand or your web design that’s giving customers pause. It’s your pricing.

When shopping online, up to 87% of shoppers say price is the most influential factor in their buying decision. Nearly half (49%) of shoppers abandon their cart due to unexpected extra costs.

Clearly, price is one of the most common sticking points for customers. It’s also where Buy Now, Pay Later (BNPL) can be an ecommerce retailer’s secret weapon.

By splitting up the total cost of a purchase into multiple installment payments, your shoppers can afford to make more frequent or higher value purchases — and you can boost your conversion rate in the process.

Are you considering hopping on the BNPL train? Read on. We break down how BNPL works, why it’s become so popular and the major benefits it can offer retailers, from increased conversion to customer loyalty.

How Buy Now, Pay Later Works

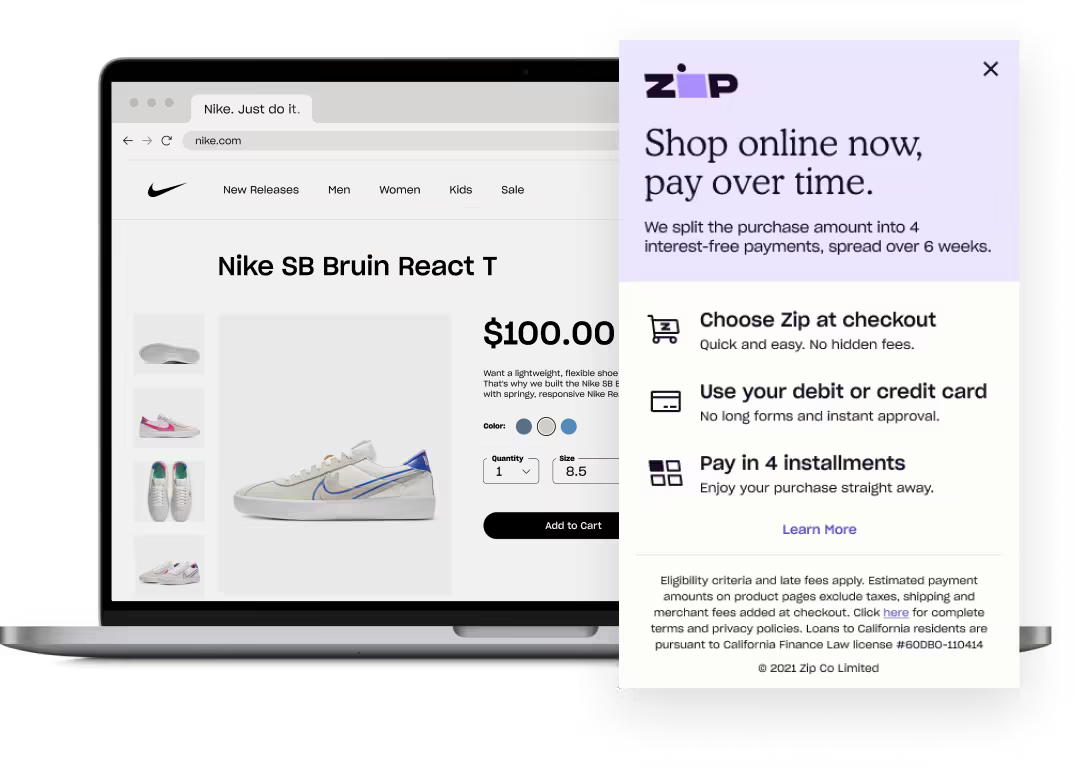

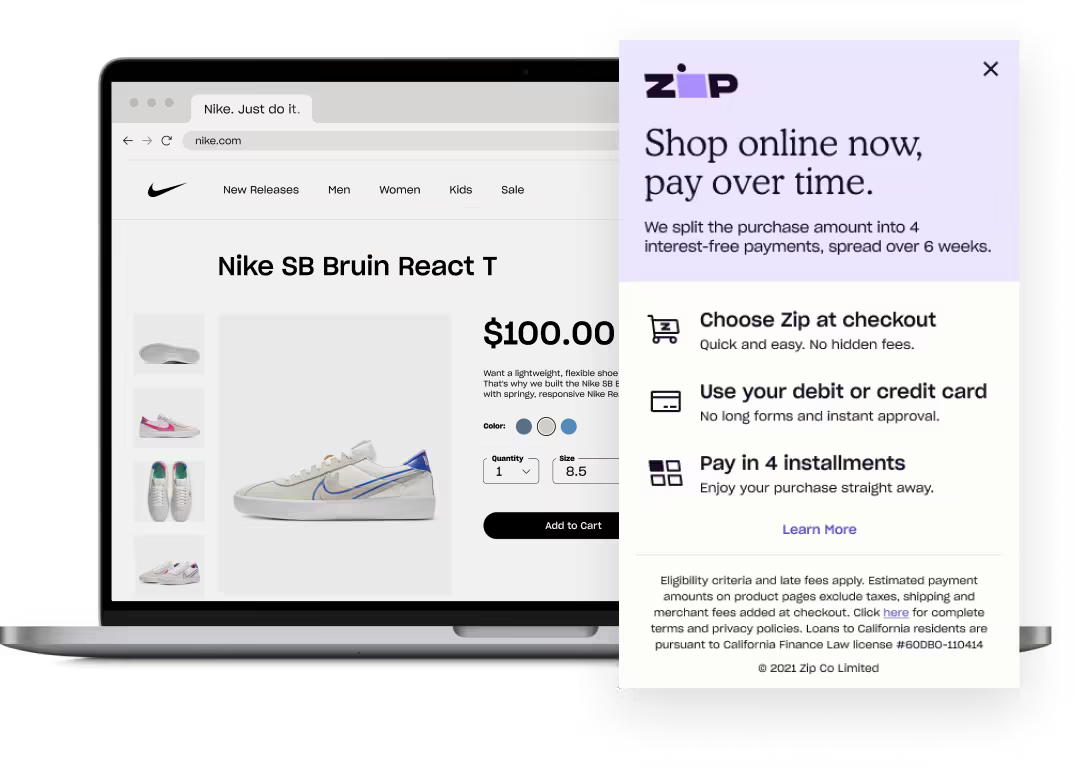

Buy Now, Pay Later, or BNPL for short, works the way it sounds: a customer buys something now, and pays later. Here’s what that actually looks like:

1. A customer adds something to their cart.

2. If they opt to check out with BNPL, they’ll get to split the cost of their purchase into a handful of smaller payments, usually four to six, over a period of several weeks or months.

3. At the time of check out, the customer only pays the first installment.

4. The merchant processes the order as usual, and ships it out to the customer.

5. The BNPL provider pays the total purchase cost to the merchant, minus any processing fees, so the merchant is made whole immediately. Over the ensuing weeks, the BNPL provider collects the remaining payments from the customer.

The beauty of BNPL is that a consumer can purchase what they want, when they want it, without having to worry about breaking the bank in the process. They can split the cost of a purchase into manageable payments that fit their budget. The merchant, meanwhile, enjoys the benefits of increased conversion and cart totals, without assuming any of the risk — that’s all taken on by the BNPL provider.

In some ways, BNPL combines all the best parts of credit cards and layaway, without any of the drawbacks, and modernizes them for the digital age. Consumers don’t have to deal with high-interest credit cards, and merchants don’t have to worry about collecting payment.

The Shift Away from Credit: Changing Consumer Payment Preferences Over the Past Decade

Starting with the 2008 Great Recession, the past decade-plus has witnessed an overall shift in consumer behavior away from credit and towards alternative payment solutions like BNPL, debit cards, and digital wallets. In fact, digital and mobile wallets now represent 45% of ecommerce payments.

In large part, millennials have driven this shift away from credit cards. Having now experienced two global financial crises firsthand (the Great Recession and the COVID-19 pandemic), an increasing cost of living, and overwhelming college debt (300% higher than Gen Xers), millennials are more in debt than any other generation. As a result, they are extremely wary of credit cards and their potential to rack up debt.

Nearly a quarter of millennials don’t have a credit card — however, they’re not the only ones reeling in credit card debt. Generation X and baby boomers carry more credit card debt, on average, than millennials.

To avoid debt, many consumers have turned to less risky payment options like digital wallets, debit cards, and BNPL. Among these, BNPL is the only one that allows consumers to purchase items without having cash on hand, similar to a credit card. But unlike credit cards, BNPL offers the unique advantage of not impacting their credit score.

It’s no surprise, then, that as many as one in three shoppers use BNPL specifically to avoid using credit cards.

Consumers Love BNPL and These Stats Prove It

Consumers have welcomed BNPL with open arms. Let’s take a look at these telling stats on BNPL usage.

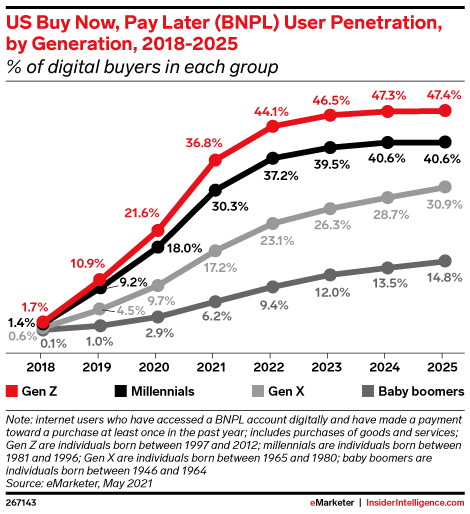

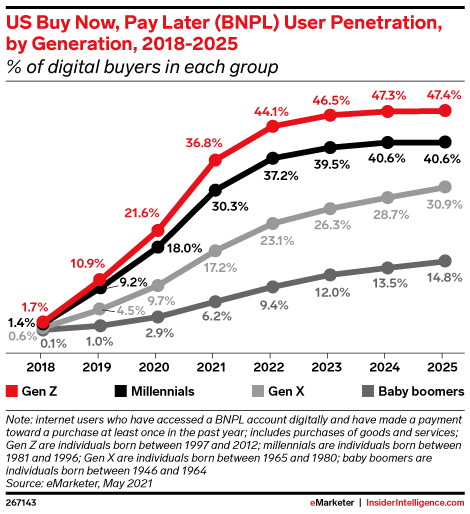

1. BNPL is popular across generations.

Currently, Gen Zers and millennials represent nearly 75% of BNPL users. Over the next few years, Gen Xers and baby boomers will eat into that share, soon representing nearly one in three BNPL users. As Gen Zers continue to amass spending power, BNPL usage will only continue to grow, according to expert predictions.

2. BNPL usage is quickly becoming mainstream.

BNPL usage is catching on — and quickly. In particular, the past year accelerated its growth, with a global pandemic stretching people’s budgets and consumers shopping online more than ever. Since the start of the pandemic, BNPL’s user base has grown 85% in just fifteen months.

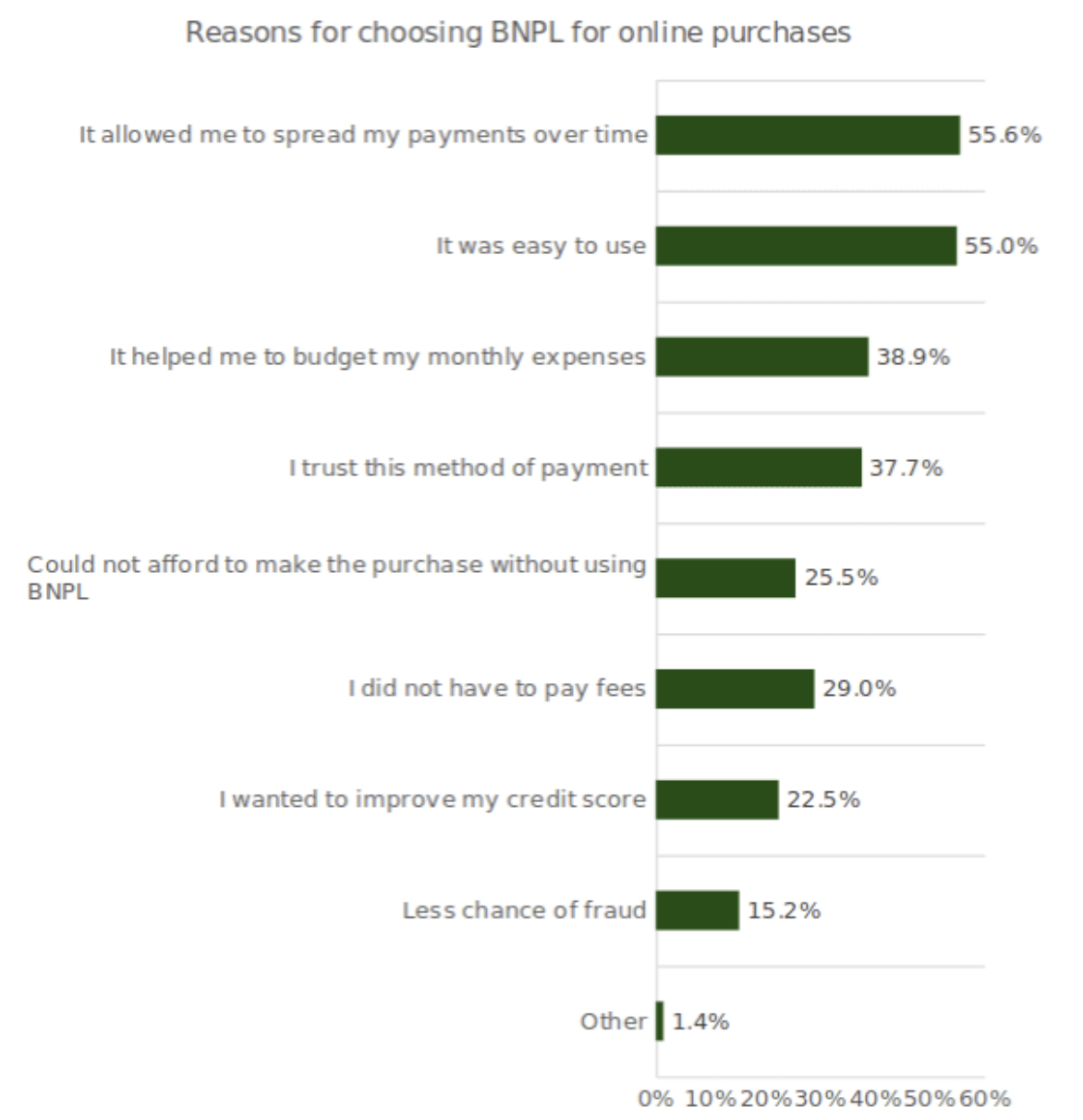

3. BNPL shoppers prize convenience and affordability above all.

Over half of BNPL users choose BNPL for their ecommerce purchases because it’s easy to use, and it allows them to spread their payments over time. Notably, nearly four in ten shoppers choose the flexible payment method specifically because they “trust it.”

Benefits of BNPL for Ecommerce Retailers

The popularity of BNPL extends to ecommerce merchants as well, with merchants enjoying more customers and increased conversion as a result of accepting BNPL at checkout.

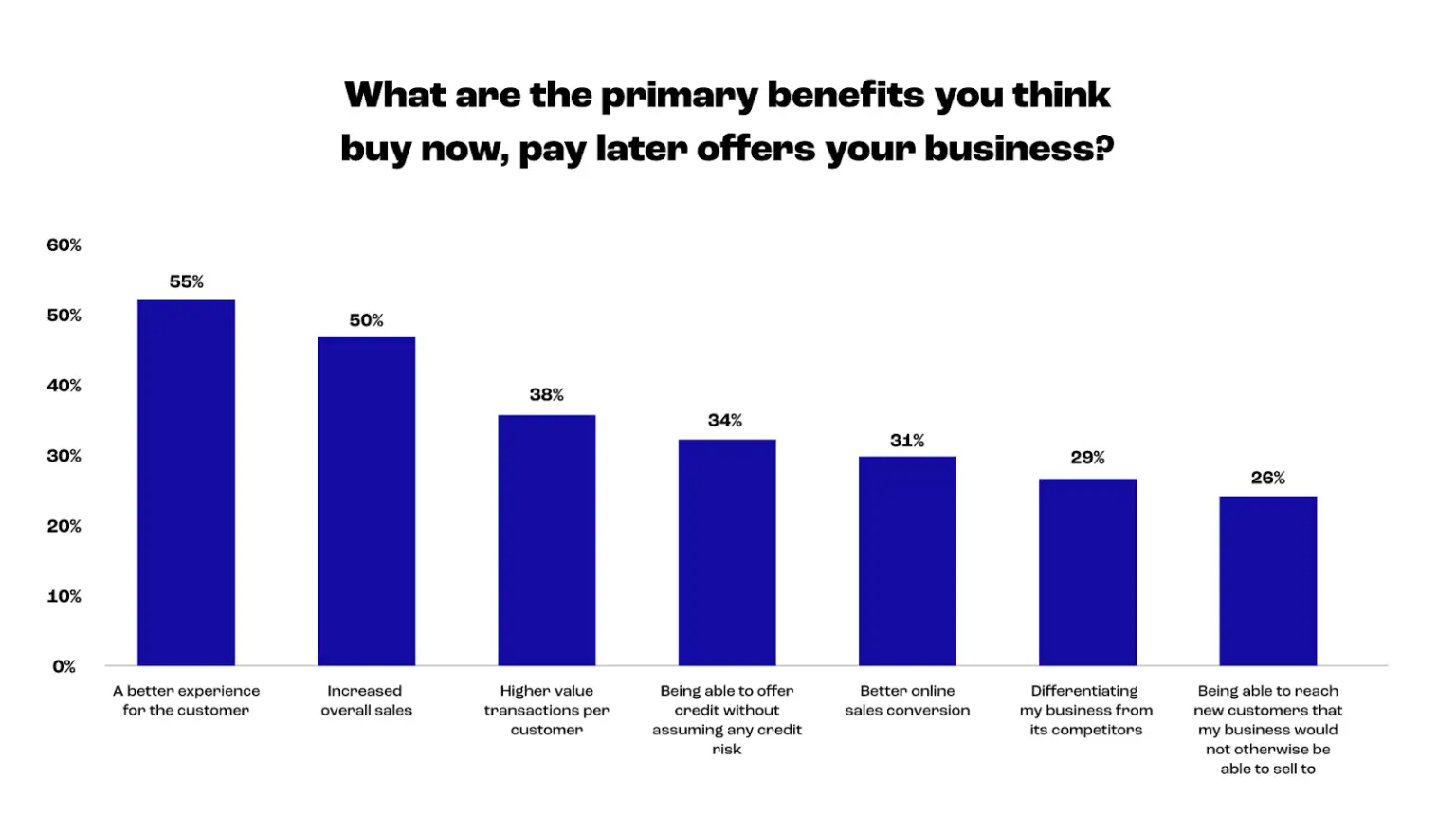

1. BNPL-accepting merchants cite increased sales as a top benefit.

Half of BNPL-accepting merchants cite increased sales as the top benefit BNPL offers their businesses. That helps explain why one in four ecommerce retailers already accept BNPL at checkout.

Beyond making purchases more affordable for current customers, BNPL also helps brands reach previously inaccessible customers, including shoppers who can’t afford a purchase upfront as well as those who don’t carry a credit card (which, as we mentioned above, describes one in four millennials).

2. BNPL boosts average order values (AOVs).

Since BNPL allows consumers to split the total cost of their purchase into more manageable payments, it makes sense that it also enables them to make larger purchases in the first place. Nearly half of BNPL users say this payment method enables them to spend 10% to 20% more than they would have been able to by using a credit card alone.

3. BNPL reduces friction throughout the funnel.

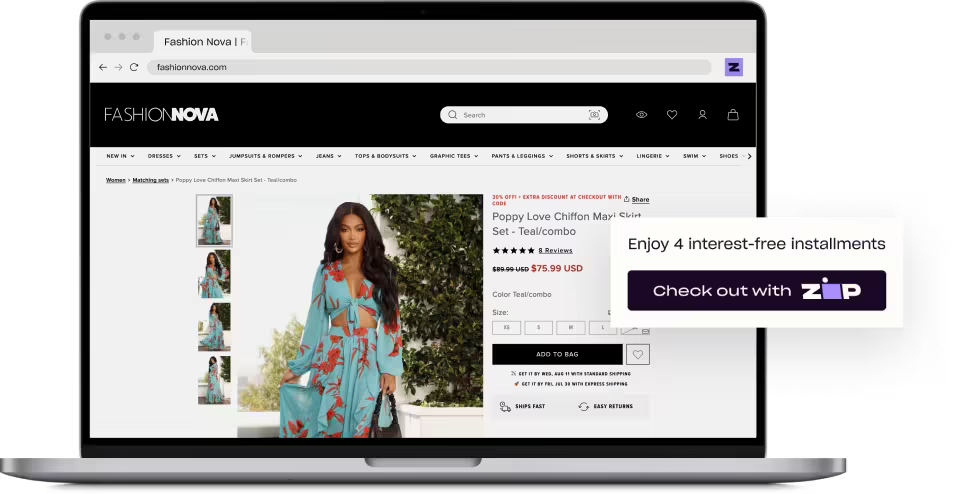

BNPL is so effective at boosting conversion in part because it reduces friction. Customers see prices at two critical moments in the buying process: when they visit a product page and when they check out. If they are presented with BNPL at the same time, they’re shown a much lower, more manageable price. This removes hesitation for the customer both when deciding whether to add something to their cart, and when they click to check out.

Add BNPL to Your BigCommerce Store

If there’s one ecommerce holiday trend we can count on, it’s that BNPL is here to stay. This fan favorite payment option is popular among consumers and retailers alike.

Want to add BNPL to your BigCommerce store? It couldn’t be easier. With Zip’s BigCommerce integration, adding BNPL to checkout takes less than 10 minutes. All you have to do is download the Zip widget for BigCommerce.

Join the +50,000 global merchants already using Zip to let your customers buy now and pay later, and watch your online sales grow. Get started now.

![]()