In a perfect world, every single human would love your product. But, as we all know – life isn’t perfect.

We, humans, are unpredictable creatures when it comes to articulating what we like and why.

An online business owner’s job is full of guesswork when it comes to determining what products or marketing strategies will land with their target audience and which ones will not.

In 2009, Tropicana decided to change the looks of their famous orange juice carton. They designed a new minimalistic packaging in a slightly different color pallet and changed the logo.

Overall, the team spent over $35 million for rebranding and subsequent promotion.

Image Source

And then…customers hated it.

Tropicana received a ton of consumer complaints on social media about the new design. People were frustrated with the company’s decision to emulate cheaper generic store brands.

In two months after the redesign, Tropicana’s sales plummeted by 20%.

The brand bit the bullet and restored the original packaging eventually.

This cautionary tale is a great example of why doing target market analysis is equally important for big and small businesses alike.

If it’s been a while since you last analyzed your market segments, this guide offers a must-do refresher.

What is a Target Market?

A target market is a portion of an addressable market you plan to sell your products to. The purpose of targeting (or market segmentation) is to help you identify the most likely buyer demographics and allocate marketing resources accordingly.

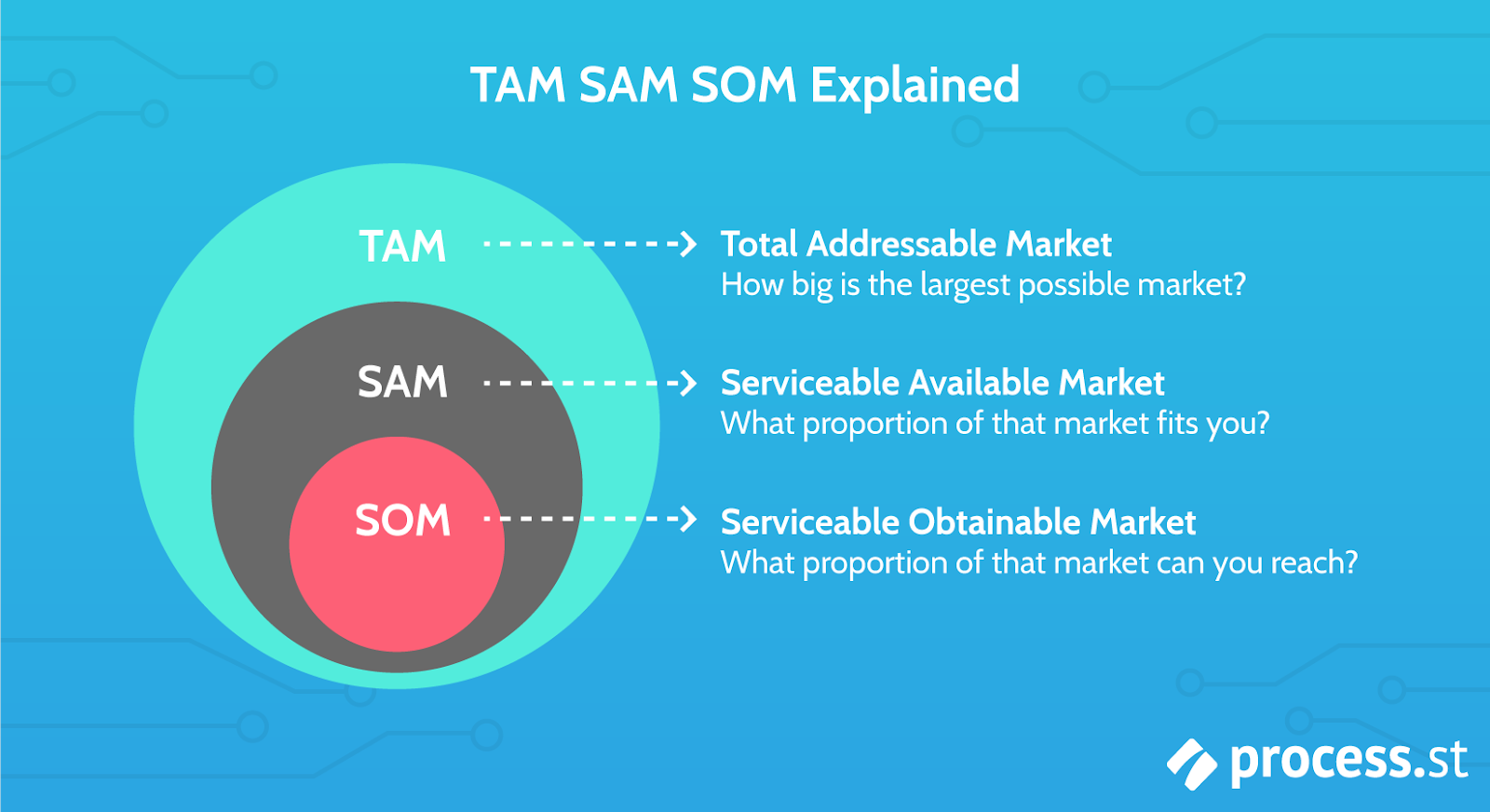

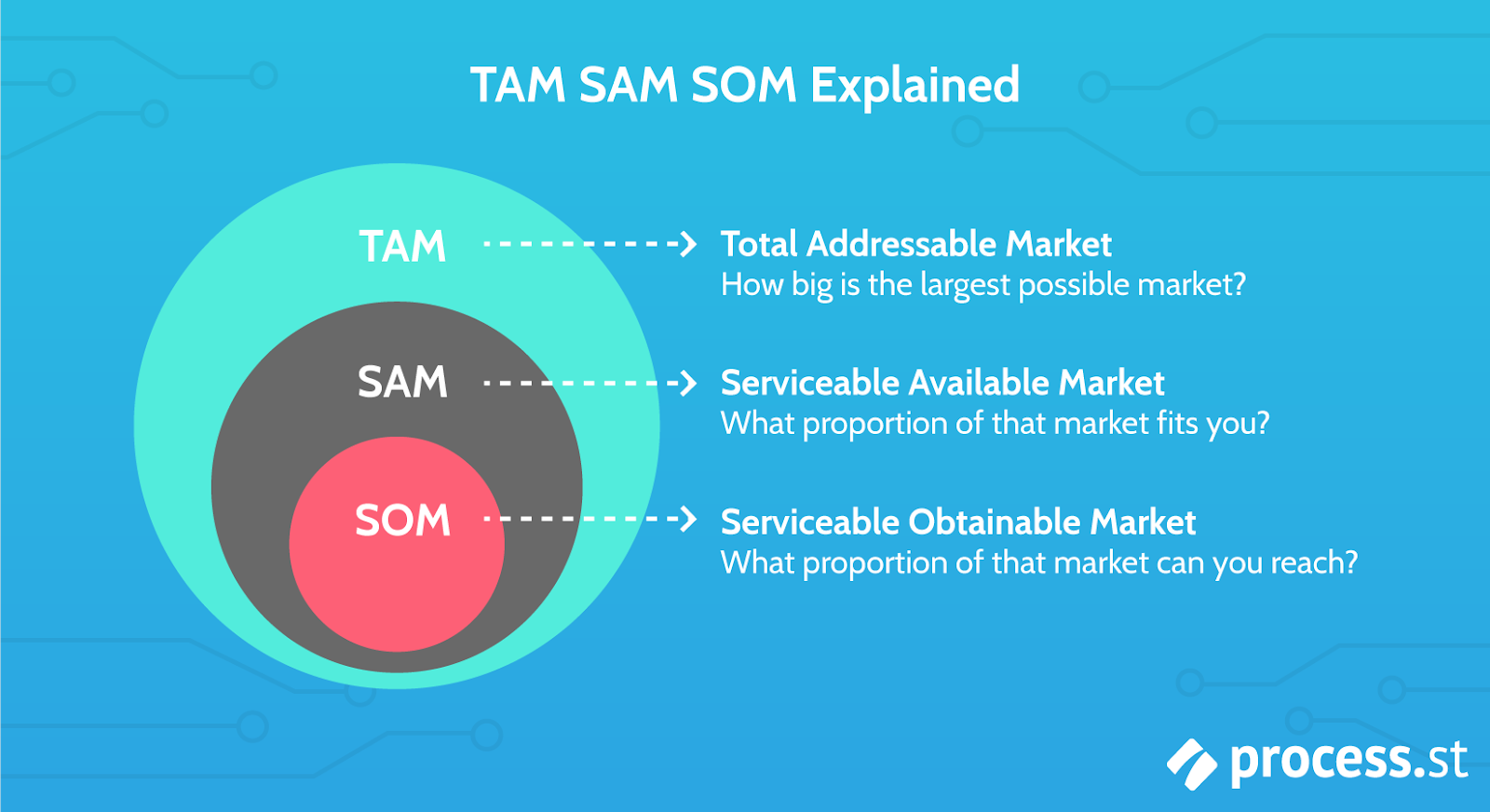

Furthermore, a target market can be drilled down to:

- TAM — total addressable market or all the people who may demand your products.

- SAM — the serviceable available market is a portion of TAM within your geographical reach.

- SOM — the serviceable obtainable market is a slice of SAM you can effectively capture.

Image Source

SOM can be further broken down into specific buyer personas — fictional representations of your ideal customers, built around qualitative and quantitative data such as demographic information, personality insights, buying behaviors and other commonly displayed attributes.

Benefits of Target Market Analysis

Customer intelligence is key to understanding how you can market your online store in the most effective way:

Less than 40% of marketers are relying on consumer research to make the above decisions. Moreover, target market analysis also helps accomplish the following tasks:

1. Determine the markets that bring the most value.

Depending on your niche and operations size, the total serviceable obtainable market can be several hundred million, spanning over different locations, age groups and buyer personas.

Let’s take skincare as an example. The total SOM can include audiences such as “females aged 25-35,” “Gen Z men aged 18-25,” “eco-concerned consumers,” “people with sensitive skin,” “luxury skincare shoppers,” “budget-conscious students.”

These are a lot of different people with different needs and purchasing preferences. Which ones should you target and how? Target market analysis helps you get those answers.

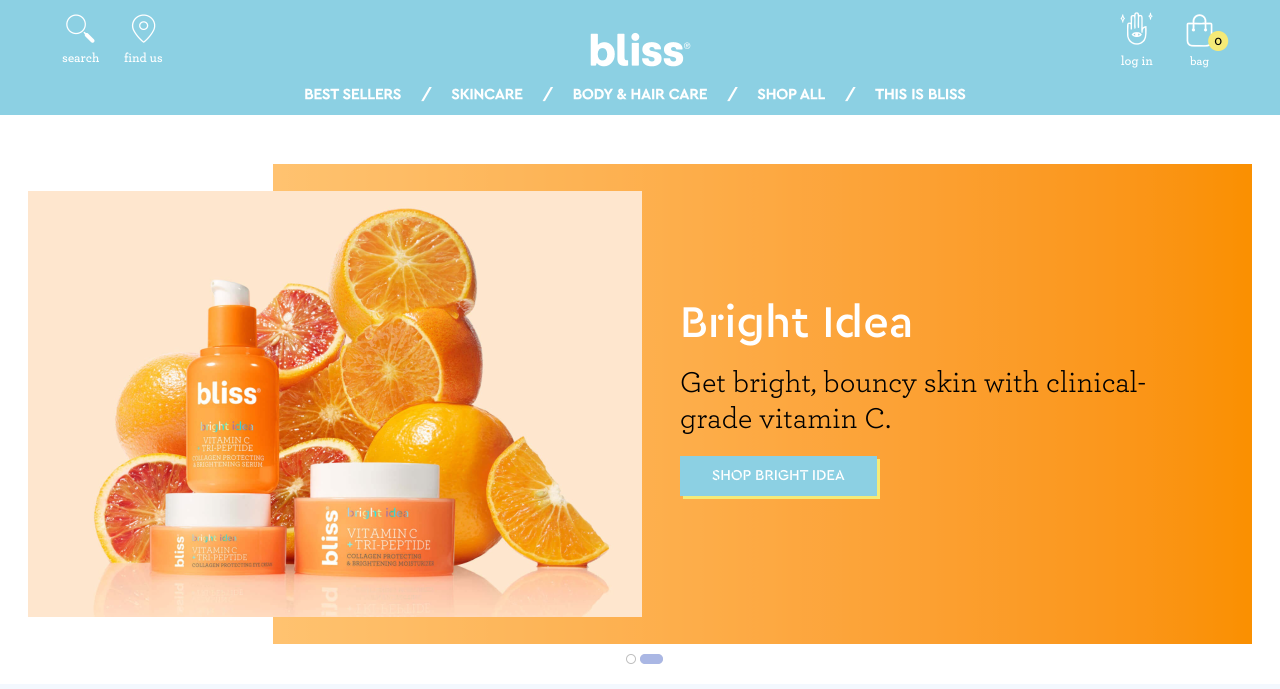

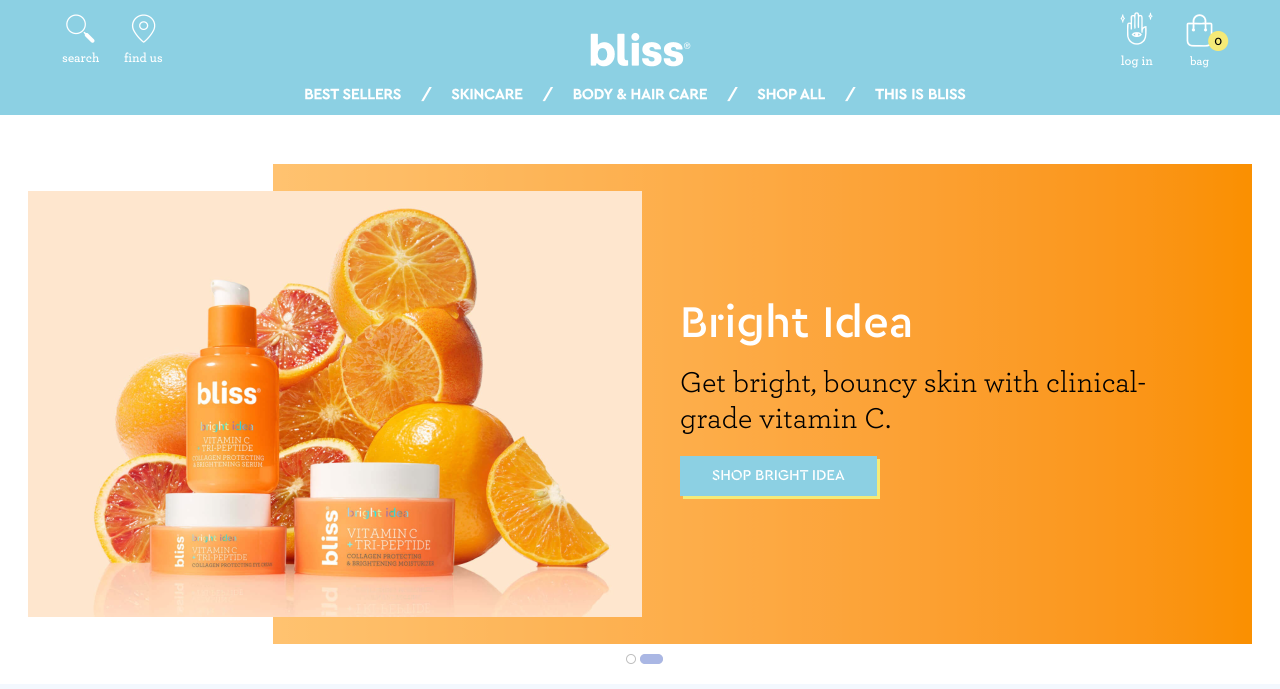

When Bliss, a once iconic NYC spa, decided to make a major comeback in 2016, the first thing the newly appointed CEO Meri Baregamian did was commission a consumer research into the brand. Why?

In Baregamian’s words: “[Consumers] loved the efficacy of the products, but the two key complaints were that it was overpriced and they couldn’t find it anywhere.”

The team wanted first-hand knowledge about which distribution channels to target and how to adapt their pricing strategy to reach a wider market.

The analysis prompted them to fully re-design packaging, change some product names and cut prices by around 50% across the board. And that’s how the current Bliss brand and online store came to life:

Image Source

2. Evaluate the viability of a new product.

Product viability research is the cornerstone element of target market analysis.

When there’s no solid demand for your product type, you can have a difficult time scaling your operations and end up with a lot of dead stock.

This type of consumer research is especially crucial if you plan to bring a novel product to the market.

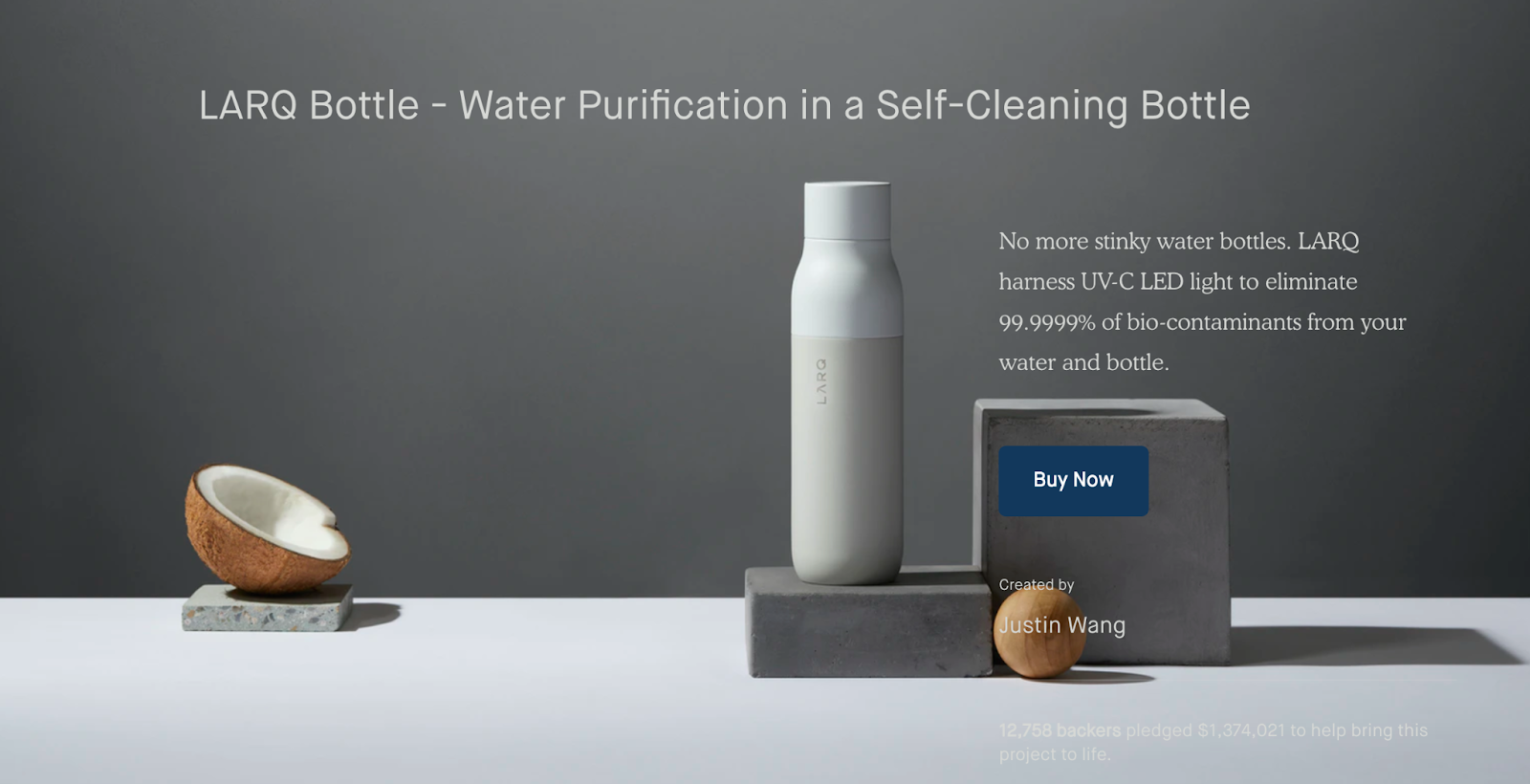

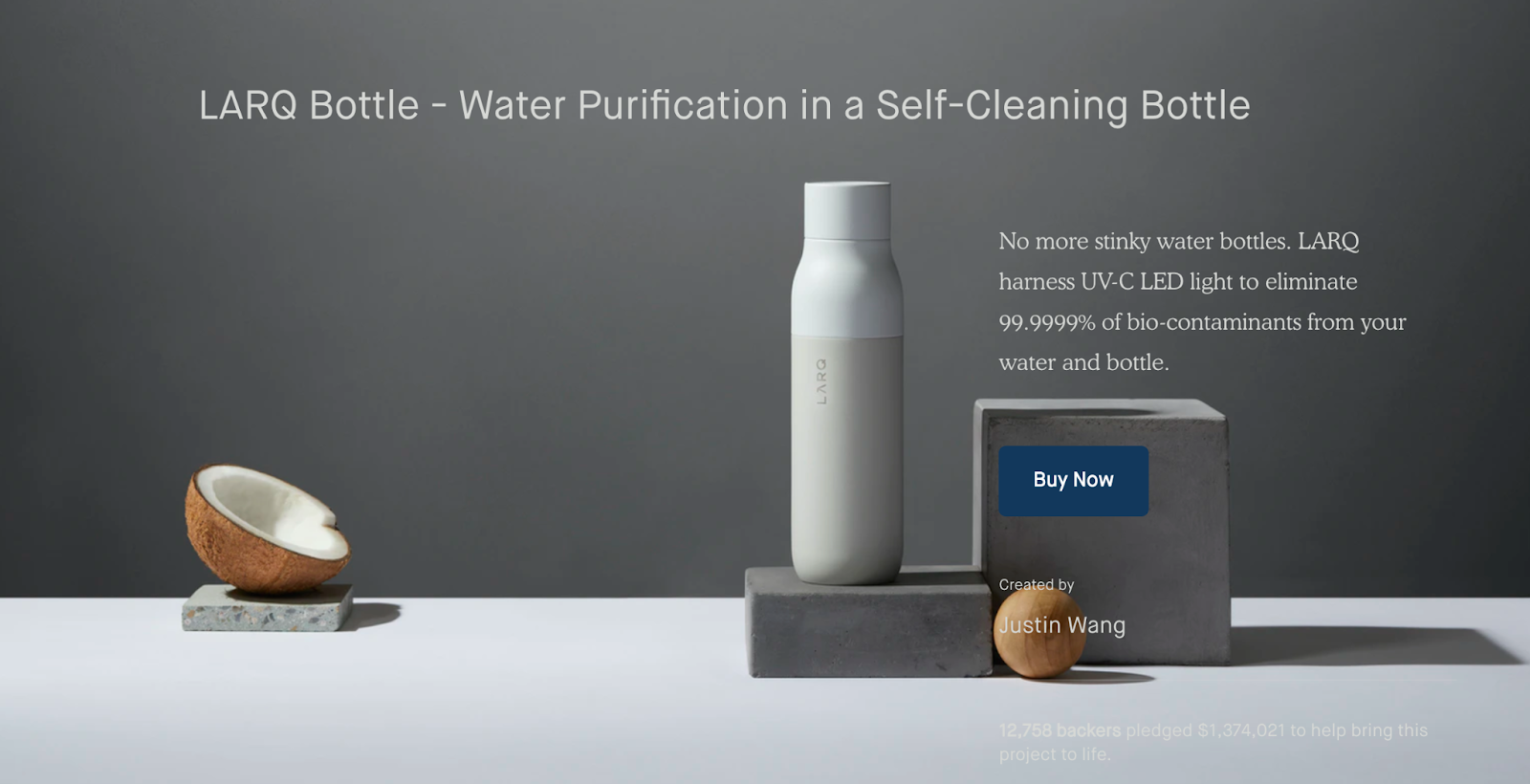

Take it from the LARQ team.

Before Justin Wang launched LARQ — a self-cleaning, reusable water bottle — he experienced the dread of finding a good plastic bottle alternative first-hand. He had tried between 10 and 15 different reusable water bottles, but none felt quite right. This prompted Justin to conduct further market research and compare the staggering figures on single-plastic usage.

Eventually, the analysis prompted him to design LARQ. Then he tested his product concept by doing a crowdfunding campaign in 2017, which turned out to be a blast. Instead of $30,000, the team amassed over $1.3 million in backers support. The money went straight to product development.

Image Source

3. Discover new exciting markets to test.

Target market analysis is also a proven tool for discovering untapped ecommerce niches and emerging market trends.

Last year was a great example of how rapid response to tectonic shifts in consumer behaviors can lead to successful pivots and break-neck growth across some sectors.

But even in more “ordinary” times, target market analysis can help you discover new audiences for your brand.

For instance, a 2018 survey of British female beer drinkers found that male-oriented advertising averts up to 48% of 18-24-year-old women from buying beer. Yet, many beer brands keep focusing on male audiences only and this is definitely an overlook!

With target market analysis, you can uncover such granular insights about micro-niches and specific buyer personas to improve your product range, brand positioning and marketing.

How to Identify and Analyze Your Target Market

Target market analysis is a deep-dive investigation into your audiences’ problems, needs, behaviors and preferences. Your goals are:

- Establish what problem your products can solve

- Understand who’s the most likely to need this solution

- Learn what secondary audiences are worth pursuing

- Test new marketing channels for reaching the identified segments

Now let’s zoom in on how to get the above done!

1. Gather intel.

Your goal is to collect two types of data:

- Quantitative insights — numbers, clean-cut facts and statistics about your targets.

- Qualitative insights — voice of customer (VoC) data, explaining customer sentiment, preferences, purchase drivers, attitudes and other psychographic traits.

There are many different methods for collecting this type of data:

- Customer surveys

- Focus group interviews

- Brand tests

- Customer sentiment research

- Pricing research

- UX research

- Product intelligence platforms

- Content analysis and more!

Choose an array of methods that will help you get answers to the following questions:

- Is the potential market for your product or service large enough?

- Do you need to alter your business idea to best appeal to this audience?

- Should you tailor your product or service in some way to maximize effectiveness?

- How can you target your marketing efforts to optimize reach with the most promising potential buyers?

The idea is to arrive at a clear-cut TAM-SAM-SOM, plus have some extra intel ready for creating buyer personas (customer profiles).

2. Create customer profiles and market segments.

A customer profile is a high-level summarized view of people who share similar demographics and psychographic traits, as well as share common behaviors.

Having detailed customer profiles is the first step to designing and optimizing customer journey maps — common purchase flows for your ecommerce store or omnichannel operations.

By knowing who your customers are and how they shop, you can fine-tune your sales funnel to better appeal to the identified segments.

Here’s the data you’ll need to create an ecommerce customer profile:

Demographic criteria:

- Age

- Location

- Gender

- Income level

- Education level

- Marital status

- Occupation

Then add psychographic criteria to go a little deeper and paint a more complete picture of your audience:

- Interests

- Hobbies

- Values

- Attitudes

- Behaviors

- Lifestyle preferences

You can obtain this data from your CRM system, customer support tickets, social media posts, surveys, interviews and an array of other market research platforms.

Also, remember that every industry, business and product is different. So these lists are by no means the end-all-be-all — think of them as more of a starting point to evaluate market segment size and opportunity!

3. Be specific.

If you ever did a paid advertising campaign on Facebook or Instagram, you know the level of granularity their targeting tools provide.

Your goal is to get as close as that.

Identifying a specific target audience helps ensure that you make decisions that are dictated by your customers, which sets you up for long-term success.

Drill down on who your audience truly is and study:

- Their attitudes,

- Beliefs and

- Pain points.

Understanding their age and income is the first step, but drilling down to the core customer problem is what will help set your products — and brand — apart from the competition.

4. Tap existing resources.

Using available online resources is a great way to collect secondary insights to back your earlier assumptions and augment first-party data — the one you obtain straight from your audiences.

However, the downside is that the research you find may not be as focused or useful as you’d like. So treat it critically and cherry-pick the most relevant insights.

Below are a few resources that will add more color to your research and help you get started:

- Quantcast provides free, accurate and dependable audience insights for over 100 million web and mobile destinations.

- Google Trends uncovers where your target customers are predominantly located.

- The U.S. Census Bureau provides up-to-date general demographics data.

- Big Four consulting firms such as McKinsey, Deloitte, Accenture and EY among others regularly publish industry briefs and customer research reports.

- Ahrefs provides a keyword data analysis tool to help you identify popular searches and content/websites ranking for them.

All of this information will help you develop more specific customer profiles.

5. Look at the competition.

Competitive analysis is a must-do for launching new products.

Also, it’s a nice activity to repeat at least once a year to ensure your offers are more attractive and relevant compared to what others are doing.

Finally, competition analysis helps you establish better brand differentiation and develop unique sales propositions (USPs) for identified segments. For the latter, doing a quick SWOT analysis can be tremendously helpful.

Here’s how to structure your competitive research:

- Analyze the competitors’ positioning and best-sellers.

- Assess their pricing strategy.

- Go on social media and read customer reviews.

- Browse on-site and third-party reviews to see any missed opportunities.

Place the above data on your SWOT template as strengths, weaknesses, opportunities and threats. Engage others on the team to brainstorm how you can capitalize on the opportunities and cover the gaps in weaker areas.

6. Conduct your own primary research.

Primary research — proprietary data collection and analysis — is a time-consuming step, requiring careful prep.

But it’s not one you can skip if you want to scale your ecommerce business.

Because this is the only way to truly listen to the voice of your customer and get answers to specific questions regarding your business.

Allocate the time and funds towards the following tasks:

- Run surveys: Social media polls are a great way to get quick answers to multi-choice questions (e.g. do you like product A or B?). Email or web-based surveys can help you collect more data — both quantitative and spoken insights for further analysis.

- Conduct interviews: Talk to consumers who might fit in your target market. Determine several prospects in your CRM that well represent the target segments. Then incentivize them to have a chat. If you have a brick-and-mortar location, ask the manager to engage with several shoppers.

- Assemble focus groups: Get feedback from a small group of consumers who fit your ideal customer profile via Q&A sessions and group discussions. Focus groups can be done online and in person. If you have a budget, you may want to recruit a company to conduct market research for you.

7. Look at your business in a fresh light.

Now that you have some serious insight into who you are selling to, it’s time to ask yourself a series of questions:

- Do you feel there are enough potential customers within your target audience to start a brand new business?

- Will your target market benefit from your product or service?

- Will this target market see a true need for it? Will they come back repeatedly to purchase?

- Do you understand what drives your target market to make buying decisions?

- Can your target market afford your product or service? If so, how frequently can they buy?

- Can you reach your market with your message? How easily accessible are they?

Going through these questions will help you better understand if you are ready to sell online or if you need to pivot your marketing focus (and potentially your products) to appeal to a different audience.

Target Market Example for Ecommerce

Let’s say you want to move into a competitive business of selling furniture online.

A cursory scan over public data showed that online furniture sales grew by 317% in Q2 2020. That’s a good first sign of demand, but will it sustain?

Another data point from Accenture also shows that among people who used to make less than 25% of their purchases online there has been a 319% increase in purchase volumes of home decor items. The sales teams also confirm increased interest among current customers.

Your next step is to learn the “what”: what matters to your customers when it comes to buying home items online?

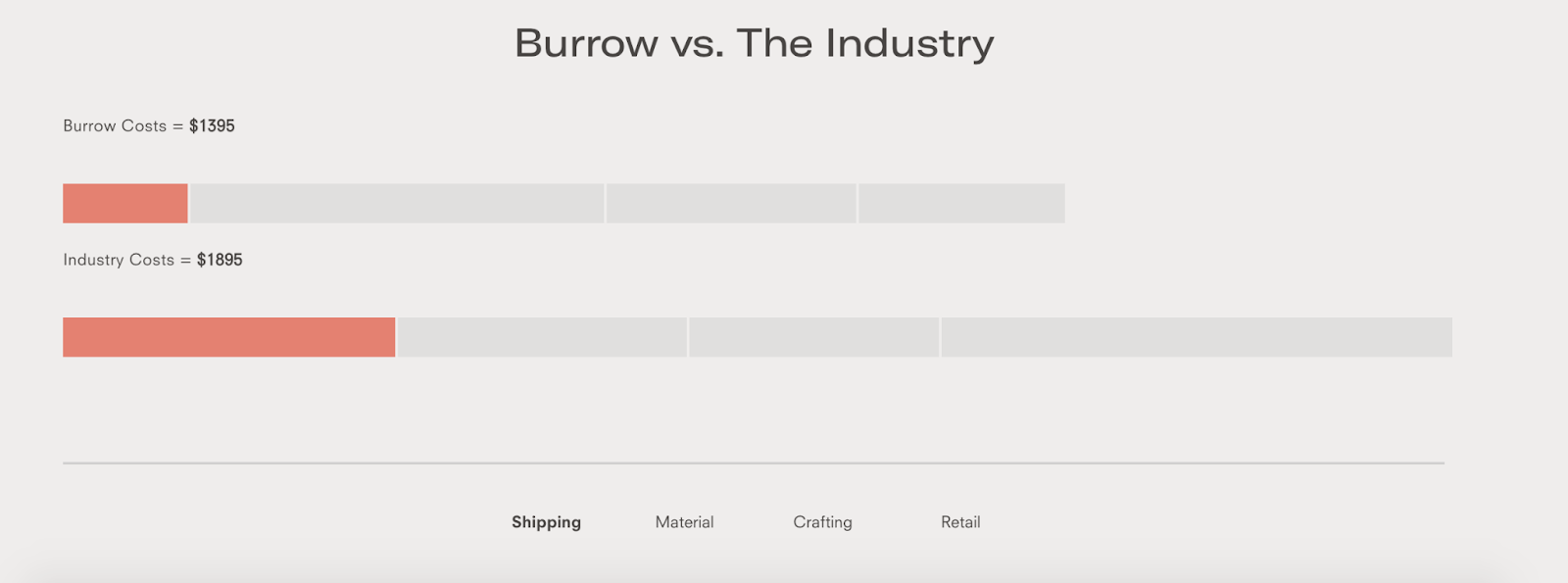

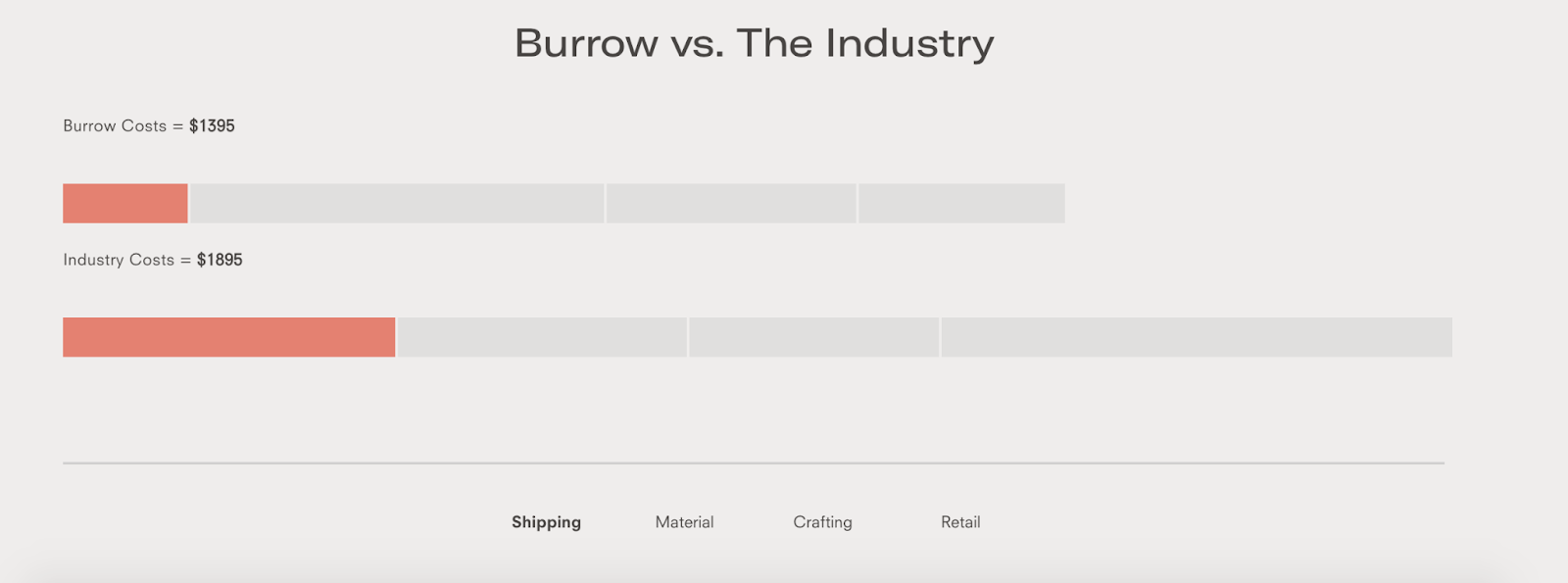

When doing his research, Stephen Kuhl, CEO and co-founder of DTC furniture retailer Burrow found that their prime target audience is millennial consumers, aged 25-35. The team also learned that “ People want to know why they are buying something and why what they are buying is the best thing.”

This prompted Burrow to provide full visibility into how their products are made and what goes into pricing.

Image Source

The team clearly communicates that they are not skimming on materials or craftsmanship, but offer better prices because they have optimized distribution and shipping strategies.

Speaking of shipping, Burrow also decided early on to emphasize its fast and free shipping without a purchase minimum in contrast to many competitors — a factor important for their young, urban-dwelling target customers who prioritize convenience.

The takeaway: Instead of trying to appeal to all, study a specific target segment. Learn what’s important to them and how you can solve their main problems. Build your customer experience and target marketing strategies around these competitive strengths.

Wrapping Up

The toughest part of target market analysis is letting go of your assumptions.

As tempting as it is to fill in the blanks, you should engage with your potential customers and conduct as much research as possible.

As your business grows, you should continue to evaluate and stay up to date with your target market.

Your target market is absolutely dynamic. It’s always evolving and taking new bends! So don’t forget to get back to the drawing board once in a while to reassess your targets and perhaps discover new promising markets to go after!

Target Market Analysis FAQs

1. What are the four main levels of target markets?

Geographic, demographic, psychographic and behavioral data are the four research layers you should look at when analyzing a new target market. Using these four vectors you can segment the total addressable market into more specific buyer personas and develop a highly effective strategy for pursuing them!

2. How do you define a target market?

To define a target market you’d want to go after you’ll need to answer six questions. Who is your most profitable primary audience? What shared needs, traits and characteristics do they have? When are they most likely to need or buy your products? Where do they shop and get information? Why will they want to purchase from you over a competitor? How do they act and decide to buy?

3. What are the 4 methods of targeting?

The four popular targeting methods are mass targeting — the least effective “spray and pray” approach to getting in front of anyone within the total addressable market. Segmented targeting — a differentiated marketing strategy, aimed at adjusting your offers to specific audience segments. Personalized targeting — data-backed campaigns, aimed at specific buyer personas. Hyper-personalized targeting — granular campaigns, aimed at reaching specific prospects/leads.

4. What are the types of targeting?

Modern marketing tools let you target prospects on multiple levels based on their demographics, psychographics and behavioral data. The popular types of targeting include contextual targeting, behavioral targeting, remarketing, predictive targeting and personalized targeting.

5. How do I describe my target market?

The easiest way to describe your target market is by creating customer profiles, also known as buyer personas — data-based, succinct representations of customer segments you plan to target. A detailed customer profile features both demographic and psychographic data such as customer’s attitudes, beliefs, preferences, values, etc.

6. What are the methods of market research?

The two popular groups of market research methods are quantitative and qualitative research. Using quantitative research methods such as surveys, questionnaires, social sentiment analysis, price research, etc. you can get numbers and figures, explaining your market size, depth and composition. Qualitative market research methods such as customer interviews, focus groups, content analysis help you obtain spoken insights and feedback on consumers’ attitudes, values, purchase drivers, etc.

7. How do you conduct simple market research?

The simplest way to perform market research is to start small. First take publicly available (secondary) data about your market — size, trends, purchasing power, etc. Determine your preliminary TAM-SAM-SOM. Then analyze the competition in this space. Use the collected data points to make a SWOT analysis of your online brand. Then, brainstorm where you can get more primary data — direct customer feedback. Social media and online communities are a good way to start.

8. What should be included in target market research?

A target market research for an ecommerce store should feature data about the total addressable and total serviceable market you plan to reach. Put down data regarding the market size, consumer purchasing power, trending product categories, biggest competition, average prices among them, opportunities for differentiation. Then analyze your and competitors’ customer bases to determine which types of buyer personas are worth going after.

9. How do you target new customers?

The best way to target new customers is to learn what impacts their buying decisions. Go online and analyze reviews and social media posts around other products. Host surveys to understand what your targets struggle with the most and what matters to them when it comes to your product category. Don’t just focus on product qualities — scoop their preferences when on the overall CX.

10. How do you introduce a product to a customer?

The optimal way to introduce a new product to potential customers is to ensure its strong market fit. Take the time to analyze the customers’ sentiment around prices, branding, packaging and different product qualities. Compare what the competition offers and how you can do better. Using this knowledge, create a product launch campaign that speaks directly to your customers’ needs.

11. What is a segmentation strategy?

A market segmentation strategy helps you discern the total addressable target market into smaller segments, based on demographic, geographic or psychographic data, so that you could personalize your marketing and sales strategies to more precise audiences and gain higher conversion rates as a result.