Hey everyone! Let’s talk about something that can be a real pain for e-commerce businesses: VAT exemptions. Managing different VAT rules, validating customer exemptions, and ensuring accurate reporting can feel like navigating a minefield. But what if I told you there’s a way to automate this entire process and reclaim your valuable time? Enter the Magento 2 VAT Exemption extension – your new best friend for simplifying VAT complexities.

The VAT Puzzle: Why it Matters for Your E-commerce Store

Imagine this: you’re running a successful online store, orders are pouring in, but you’re spending hours manually verifying VAT exemption certificates, correcting errors, and desperately trying to keep up with ever-changing regulations. Sounds exhausting, right? This is precisely where the Magento 2 VAT Exemption module shines, streamlining VAT management and freeing you to focus on what truly matters – growing your business.

In today’s global marketplace, VAT regulations can be incredibly complex. Different countries have different rules, and specific customer groups, like charities or diplomatic missions, might be exempt. Handling these variations manually is not only time-consuming but also prone to errors, potentially leading to penalties and compliance headaches. Automating VAT exemption management isn’t just a convenience; it’s a necessity for smooth and legally sound operations.

Understanding VAT Exemptions in the UK (and Beyond)

Value Added Tax (VAT) can be a complex landscape to navigate, especially for e-commerce businesses operating internationally. Different countries have their own specific VAT rules, and certain goods and services may be exempt altogether. In the UK, for instance, VAT relief is available for individuals with chronic illnesses or disabilities on essential items like mobility aids, specialist equipment, and home adaptations. This relief also extends to services related to these goods, such as installation and maintenance. (https://www.gov.uk/guidance/vat-relief-on-certain-goods-if-you-have-a-disability) Understanding these nuances is crucial for accurate pricing and compliance. While this module focuses on streamlining the process of VAT exemption, it’s important to be aware of the specific regulations that apply to your business and customer base. Consult with a tax professional for personalized advice.

Calculating the True Cost of Manual VAT Management: Time, Errors, and Lost Revenue

Manual VAT management isn’t just inefficient; it can significantly impact your bottom line. Consider the time spent verifying customer eligibility, manually adjusting tax calculations, and reconciling discrepancies. For a business processing X orders per month, this could equate to Y hours of administrative work, costing approximately £Z in labor. Beyond the direct costs, manual processes are prone to human error. Incorrectly applied VAT can lead to penalties, audits, and reputational damage. Furthermore, a cumbersome exemption process can deter eligible customers, leading to lost sales and revenue. Automating VAT exemption management not only saves time and money but also protects your business from costly mistakes and enhances the customer experience.

VAT Exemptions: Unlocking Opportunities for Specific Customers

VAT exemptions aren’t just about simplifying administrative tasks; they’re about creating opportunities for specific customer groups. Think about charities, for instance. These organizations often operate on tight budgets, and VAT exemptions can significantly impact their purchasing power. By offering a seamless VAT exemption process, you’re not only making their lives easier but also potentially opening doors to a valuable customer segment. It’s a win-win situation!

Empowering Customers and Expanding Your Reach: The Benefits of Streamlined VAT Exemptions

Offering a seamless VAT exemption process is more than just good business practice; it’s a way to empower your customers and expand your market reach. For customers with disabilities or chronic illnesses, VAT relief can make essential goods and services more accessible and affordable. By simplifying the exemption process, you demonstrate a commitment to inclusivity and build stronger customer relationships. This positive experience can translate into increased loyalty and positive word-of-mouth referrals. Furthermore, catering to exempt customer groups opens up new market opportunities and strengthens your brand reputation.

Inside the Engine: How Magento 2 VAT Exemption Works

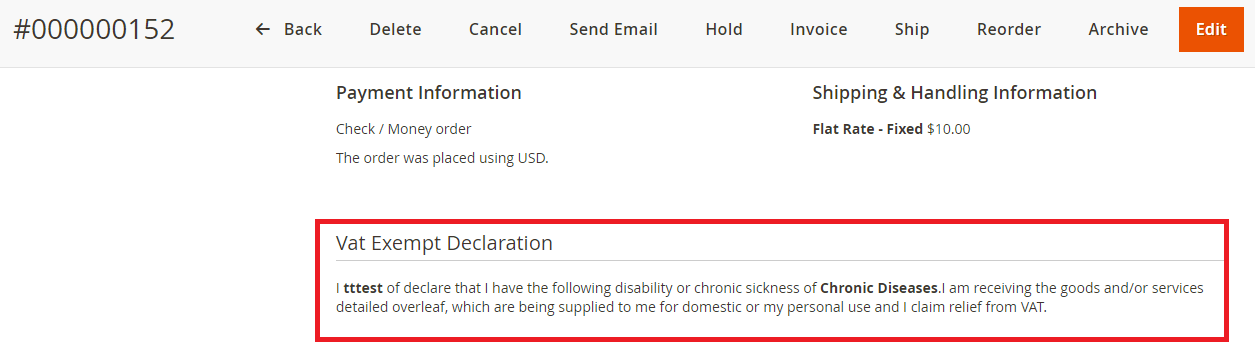

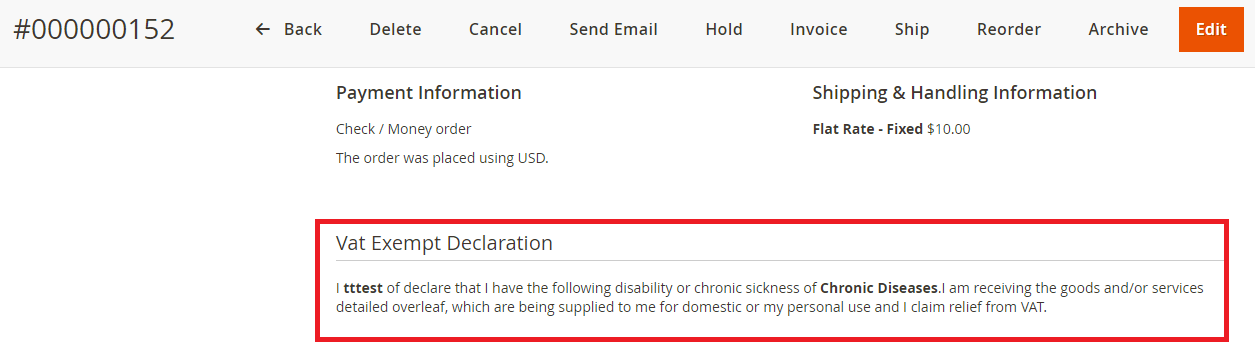

So, how does this magic happen? The Magento 2 VAT Exemption module transforms your store into a comprehensive VAT management hub, streamlining the entire VAT relief process. When customers add VAT-eligible products to their cart, they’re automatically presented with a customizable VAT declaration form. This user-friendly form allows customers to claim VAT relief by providing essential information, including their name and specific disability reason.

The module’s intelligent system automatically calculates and displays the exempted VAT amount during checkout, giving customers complete transparency over their savings. From the admin perspective, the module offers robust backend controls for managing VAT exemptions efficiently. The configurable declaration form can be strategically displayed at both cart and checkout stages, providing flexibility in when customers can apply for VAT relief.

Think of it as your store’s smart VAT management system that not only simplifies the exemption process for customers but also provides administrators with powerful tools to oversee and manage VAT-related operations seamlessly. Whether it’s processing new exemption requests or managing existing ones, everything is handled through a single, intuitive interface

Feature Deep Dive: Exploring the Module’s Capabilities

Let’s explore the powerful features that make this VAT Exemption module essential for your Magento 2 store:

- Flexible VAT Management: Easily include or exclude shipping from VAT exemption and customize VAT exempt messages to match your business needs. The module works seamlessly with both simple and configurable products.

- Comprehensive Declaration System: Display customizable declaration statements both in admin order details and during frontend checkout. Include terms and conditions with a checkbox for legal compliance.

- Customizable Disability Reasons: Create and manage multiple disability reasons through the VAT Exemption Reason grid in the backend. Customers can select their applicable reason from a dropdown menu when claiming VAT relief.

- User-Friendly Interface: Intuitive “Apply VAT Exempt” and “Cancel VAT Exempt” buttons make the process straightforward for customers. Compatible with Amasty one-step checkout for enhanced user experience.

- Robust Admin Controls: Manage VAT exemptions efficiently from the backend, including the ability to apply VAT exemption during admin orders. View detailed VAT exemption information for each order.

- Product-Level Control: Administrators can assign VAT relief eligibility at the product level through the Catalog->Products->Edit section.

- Flexible Configuration Options: Enable or disable the module as needed, customize customer notices, and manage declaration forms with ease through the backend.

- Easy Implementation: Simple installation process with comprehensive configuration options makes setup hassle-free.

- Customer Choice: Allows customers to proceed with or without VAT exemption during checkout, providing maximum flexibility.

- Form Management: Easily add, delete, or update declaration forms from the backend to maintain compliance and clarity.

Understanding the Magento 2 VAT Exemption Module Workflow

This section details the workflow of our Magento 2 VAT Exemption module, from initial configuration to the customer checkout experience and VAT application.

Initial Configuration (Detailed Steps)

1. Basic Setup

- Module Activation:

- Access Admin > Stores > Configuration > Scommerce Configuration > VAT Exempt Settings

- Toggle ‘Enabled’ to “Yes” to activate the module

- Input your unique license key

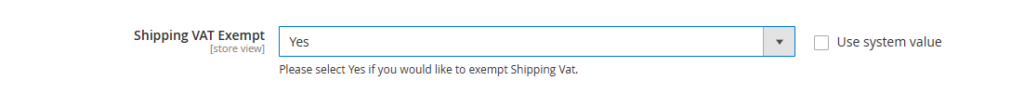

- Shipping VAT Settings:

- Choose whether to include shipping in VAT exemption calculations

- Default setting is “No” – can be modified based on business needs

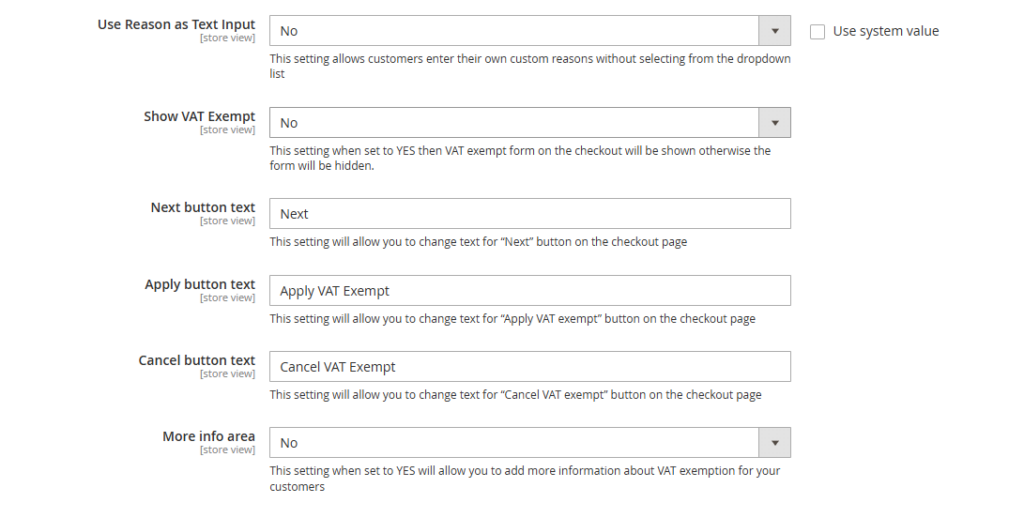

2. Message and Display Configuration

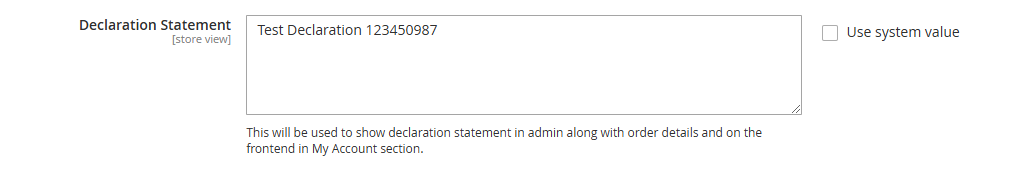

- Declaration Statement Setup:

- Customize the declaration text shown in admin order details

- Configure statement visibility in customer’s My Account section

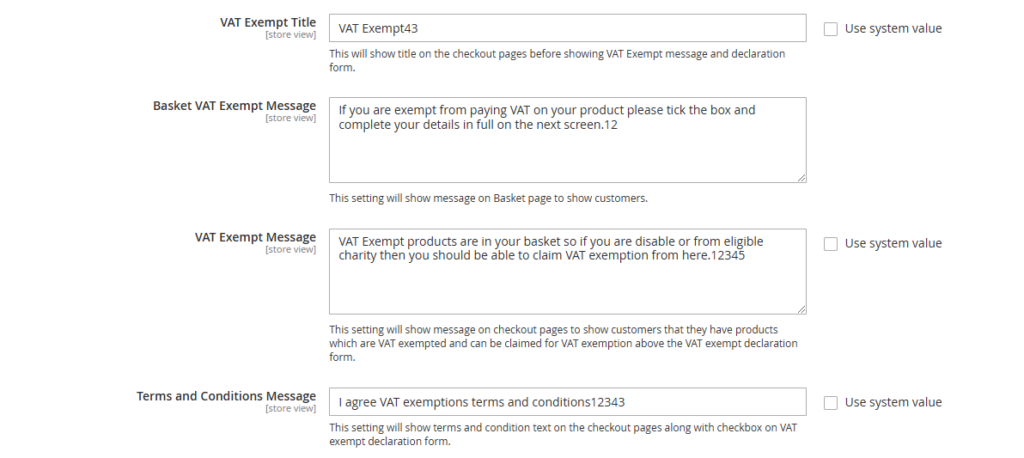

- Custom Messages:

- Set VAT Exempt Title (appears on checkout page)

- Configure Basket VAT Exempt Message (displays on cart page)

- Create checkout page VAT Exempt Message

- Draft Terms and Conditions text with checkbox integration

3. Reason Management System

- Configuring Reason Settings:

Customer Journey (Detailed Flow)

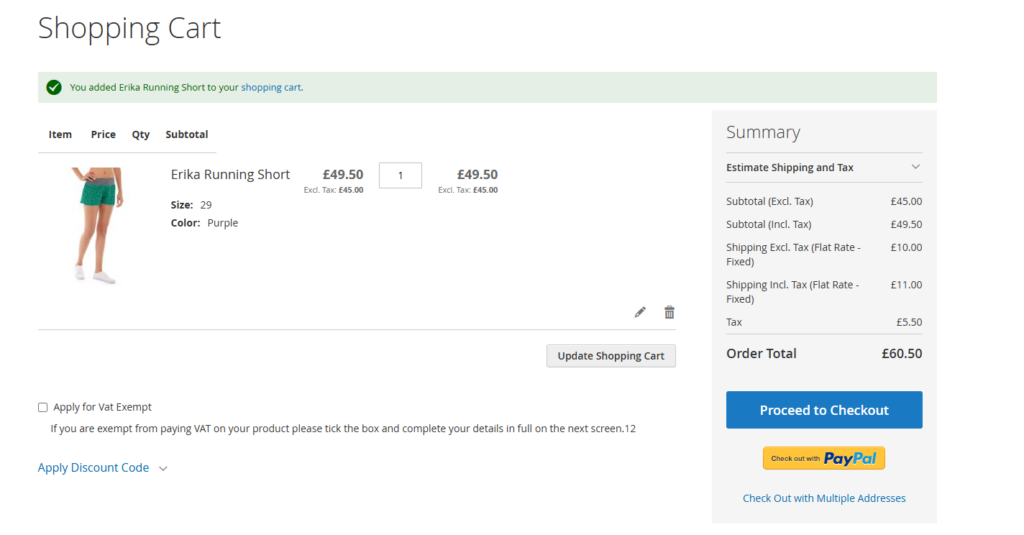

1. Shopping Cart Experience

- Initial Visibility:

- Customers see clear VAT exempt messaging

- “Apply for VAT Exempt” option appears for qualifying items

- Cart Page Options:

- Real-time display of potential VAT savings

- Clear instructions for exemption process

- Option to proceed to checkout with exemption

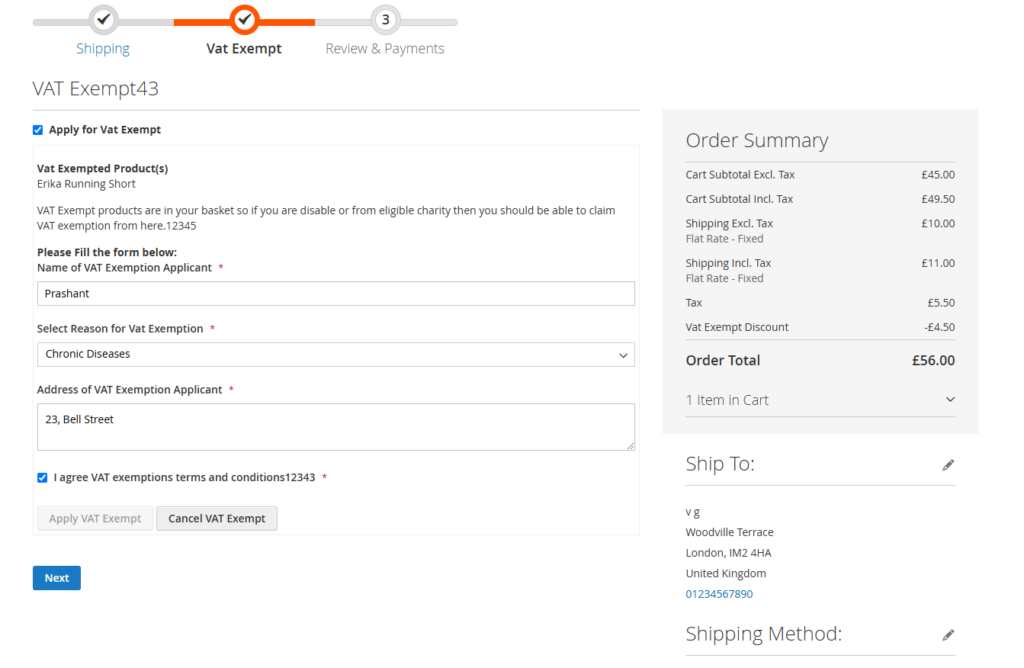

2. Checkout Process

- Form Completion:

- After shipping details, customers access VAT exemption form

- Select from predefined reasons

- Complete mandatory declaration form fields

- Accept terms and conditions

- Real-time Calculations:

- Immediate display of adjusted totals

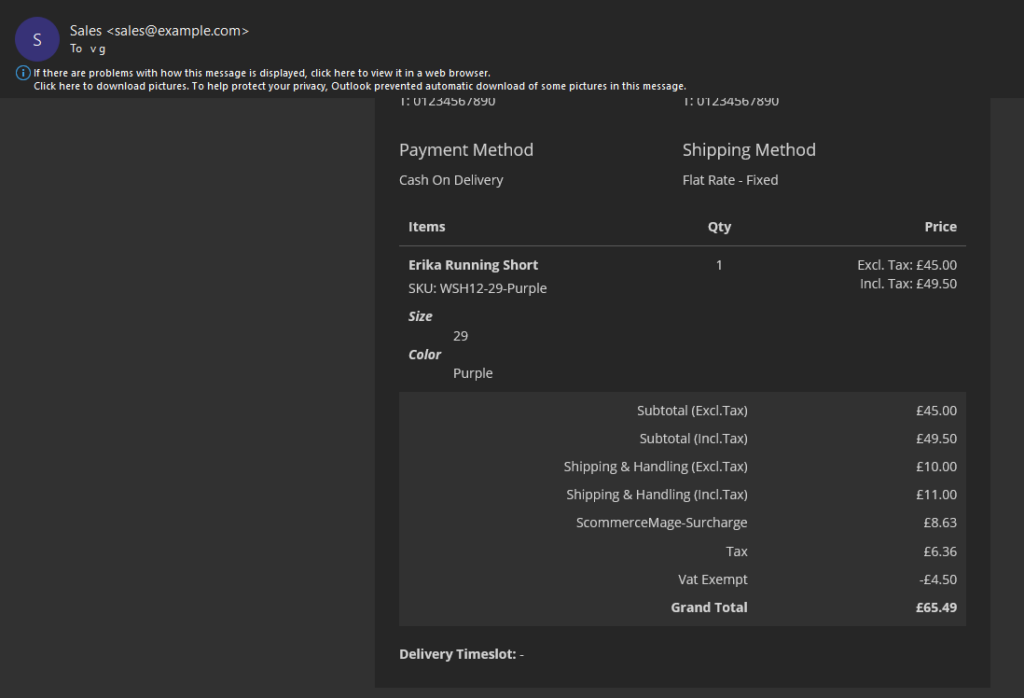

3. Order Confirmation

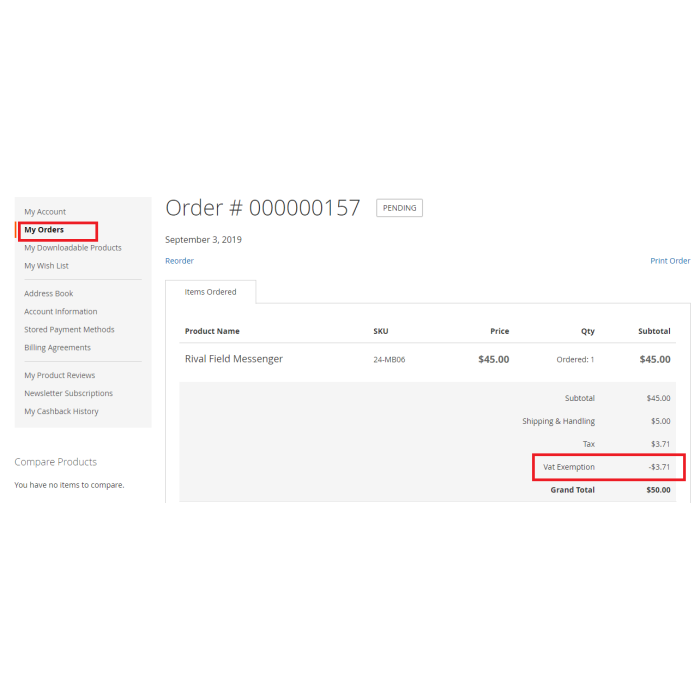

- Final Review:

- Clear display of VAT exemptions

- Display VAT Exempt in Customers My Account section

Administrator VAT Management

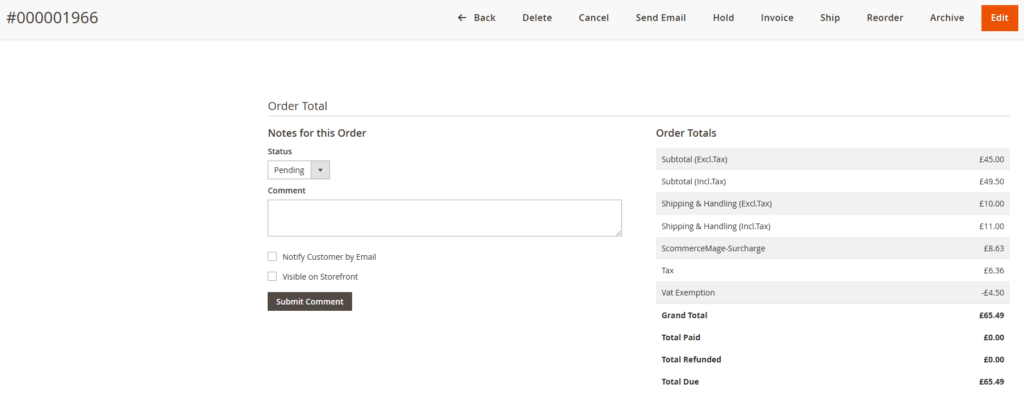

1. Order Management

- Viewing Orders:

- Access comprehensive VAT exemption details

- Monitor exemption amounts

- Clear display of VAT declaration

2. Administrative Orders

- Creating Orders:

- Option to apply VAT exemption during order creation

- Calculate accurate totals

This detailed flow ensures:

- Transparent VAT exemption process

- Easy administration and management

- Clear customer communication

- Accurate calculation and reporting

- Compliance with VAT regulations

This streamlined flow ensures both administrators and customers can efficiently manage VAT exemptions while maintaining full transparency throughout the process.

Beyond Compliance: The Strategic Advantages

The Magento 2 VAT Exemption module isn’t just about ticking compliance boxes; it’s a strategic tool that can enhance your business operations and improve customer relationships. By streamlining VAT management, you’re freeing up valuable time and resources that can be redirected towards growth initiatives.

Conclusion: Take Control of Your VAT Management

Managing VAT exemptions doesn’t have to be a headache. The Magento 2 VAT Exemption module empowers you to automate this complex process, saving you time, reducing errors, and enhancing the customer experience. It’s a strategic investment that can significantly benefit your e-commerce business, both now and in the future. Ready to see it in action? Check out our demo and discover how the Magento 2 VAT Exemption module can revolutionize your VAT management. We also offer a free trial, so you can experience the benefits firsthand without any commitment. Don’t let VAT complexities hold you back – take control and unlock the full potential of your online store. You can check the demo using the below links:-