Following a record-setting 2020 holiday season, the retail industry has been eagerly waiting to see how 2021 holiday ecommerce sales will stack up.

Multiple economic factors have contributed to the uncertainty of this year’s holiday shopping season. Global supply chain disruptions spurred anxious shoppers to buy earlier in anticipation of out-of-stock merchandise, with analyst firm McKinsey reporting 40% of consumers planning to shop sooner. Shipping carrier surcharges and the re-opening of physical retail also posed potential threats to online sales, especially as 43% of U.S. shoppers planned to make purchases from physical stores this holiday season.

Heading into the 2021 holiday season, eMarketer forecasted U.S. holiday ecommerce sales would climb 14.4% to $211.66 billion, with Cyber Monday expected to remain the top-grossing day of the season.

We now know Adobe Analytics reported the first-ever decline (-1.4%) in aggregate U.S. online Cyber Week sales. However, BigCommerce merchants achieved record sales volume and outperformed this benchmark with 15% growth in Cyber Week GMV YoY — bucking the industry trend.

As part of our annual Cyber Week Report, we analyzed BigCommerce merchant trends across the 2021 holiday shopping season at large, as well as Cyber Week (Thanksgiving through Cyber Monday) to determine shifts in consumer shopping behavior and spend.

Read on for a full report of this season’s data insights and top trends, and find out where BigCommerce merchants saw the most Cyber Week success.

Outstanding Platform Performance and Support

BigCommerce platform performance and support teams continue to provide merchants with the reliability they need to drive conversions and revenue during the busiest shopping season of the year. This year, BigCommerce saw 100% Cyber Week platform performance uptime, marking the eighth consecutive year of zero reported site downtime during the peak holiday period. BigCommerce support teams also supported over 2,500 cases across the five day period.

BigCommerce CEO, Brent Bellm, shares his thoughts on our Cyber Week 2021 results:

Methodology

BigCommerce’s holiday shopping data is based on a comparison of total platform sales that occurred between October 1–November 30, 2020 and October 1–November 30, 2021, while Cyber Week data is based on a comparison between November 26–30, 2020 and November 25–29, 2021. It represents information from thousands of small, mid-sized and enterprise global retailers selling on the BigCommerce platform.

Now, let’s dive into the trends we’ve seen across the 2021 holiday shopping season to date.

Overall Holiday Ecommerce Sales Remained Strong

1. Earlier shopping sparked YoY holiday growth.

The 2021 holiday shopping season to date has marked another year of ecommerce growth.

This year’s online holiday shopping season kicked off earlier than ever before with retailers such as Amazon and Target rolling out Black Friday deals beginning in October.

Consumers indeed started their holiday shopping earlier in an effort to get ahead of anticipated out-of-stocks and shipping delays. Global sales were up more than 20% YoY during the month of October for BigCommerce merchants, with the week of October 17–23 showing the largest spike in sales growth YoY across the holiday season to date.

Overall, October and November GMV growth continued at the same pace we have seen in recent quarters, even as merchants and consumers dealt with supply chain and other disruptions.

So, what implications did this have on Cyber Week?

2. BigCommerce Cyber Week sales still shine YoY.

Even with dollars spread across the earlier holiday season, Cyber Week saw impressive growth year-over-year (YoY) across the board for all key metrics: gross merchandise volume (GMV), orders and average order value (AOV).

BigCommerce merchants’ Cyber Week sales increased +103% from 2019 to 2021. Looking exclusively at same-store sales for stores open one year ago, GMV was up 10%. Rather than experiencing a slowdown, BigCommerce merchants continued to grow at double-digit rates.

While October saw 20% growth year-over-year, pre-holiday sales resulted in a slightly lower growth rate for Cyber Week, in line with the industry trend we’ve seen.

Following the fiscal challenges of 2020, average order value (AOV) also increased 10% from $144 to $159, suggesting that many consumers are ready to spend again.

BigCommerce VP of Global Product Marketing, Meghan Stabler, shares her thoughts on the 2021 Cyber Week performance:

3. For BigCommerce merchants, Cyber Monday led in GMV.

While Cyber Monday sales dropped 1.4% for the larger ecommerce industry, BigCommerce merchants still came out on top. Cyber Monday claimed the number one spot in GMV across the peak cyber days for BigCommerce merchants, while Black Friday claimed the most orders.

Major retailers including Walmart and Target opted to close their doors on Thanksgiving Day this year amid ongoing safety concerns and workforce shortages. As a result, more Thursday sales shifted online. Thanksgiving Day emerged as an upcoming Cyber Five contender with the largest single-day YoY GMV growth.

Customers are Shopping on Mobile

1. As mobile orders stay steady, tablets decrease.

Mobile orders remained strong this year — accounting for 42% of all Cyber Week orders.

The return of in-person family time and holiday busyness couldn’t even distract shoppers from taking advantage of deals on-the-go. Thanksgiving Day, Black Friday and Small Business Saturday all saw more mobile orders than desktop, with desktop gaining more traction on Cyber Monday as more consumers returned to the office.

Notably, tablets continued their steady decline to only represent 1.3% of Cyber Week orders. Continuing at this rate, we can project tablet sales to fall to less than 1% of order share during the 2022 holiday season.

2. Mobile makes a mark across industries.

Mobile friendliness is becoming increasingly important across all industry types. BigCommerce Fashion and Jewelry and Sports and Outdoors retailers were among the stand-out industries on mobile, with over half of their Black Friday online orders placed on mobile devices. Auto retailers also demonstrated a substantial share of mobile orders across all Cyber Week shopping days.

3. Customers shop more on iPhone over Android.

With mobile commerce on the rise, we decided to take a closer look at how purchases made on smartphones divvy up. This year, our data shows there’s a correlation between mobile devices and overall spend.

Specifically, mobile shopping on iPhones accounted for 122% more orders than Android — up 15% from last year. Plus, orders placed on iPhones showed a $14 stronger AOV of $144, compared to Android at $130.

Customers Shopped Across Multiple Channels

1. More channels bring more sales opportunities.

In 2021, BigCommerce has expanded the number of omnichannel integrations for merchants — meaning customers have more avenues for online shopping than ever before.

BigCommerce’s acquisition of Feedonomics plus partnerships with Meta, Walmart, TikTok, Mercado Libre and more have also opened up greater opportunities for merchants to meet customers where they are and increase omnichannel sales during the 2021 holiday shopping season.

Omnichannel commerce saw YoY growth in GMV and orders, confirming that not only are customers shopping more online — they’re shopping across channels.

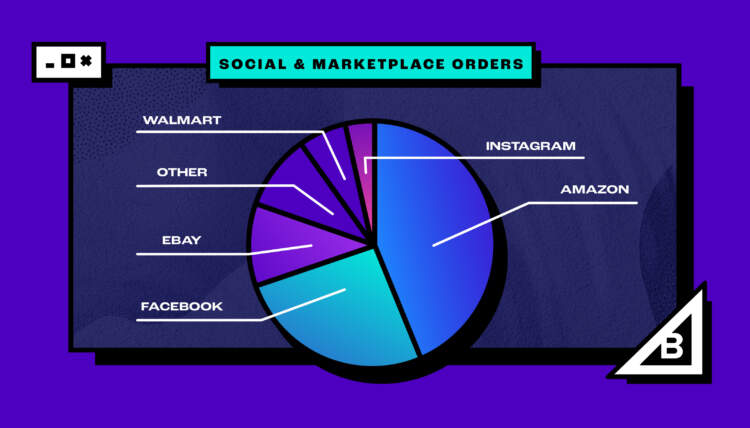

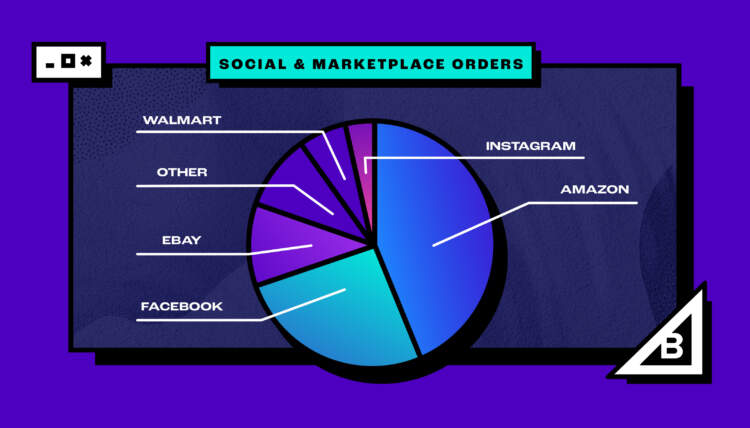

2. Amazon and Facebook come out on top in Cyber Week channel sales.

Across marketplace purchases, Amazon remains the leading Cyber Week shopping destination for consumers. Not only did the online marketplace giant capture the largest share of Black Friday dollars in the U.S. with a whopping 17.7% of the market, it also represented the largest share of BigCommerce marketplace sales.

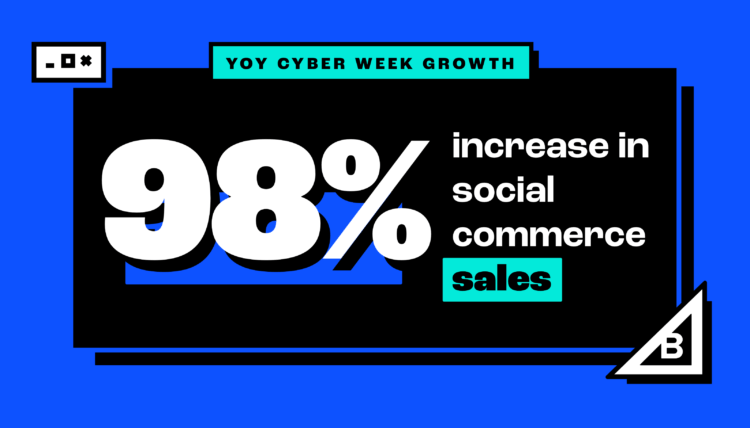

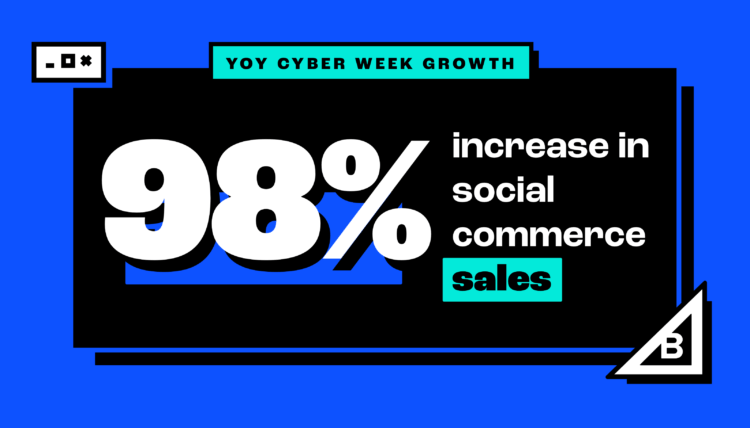

Social commerce channels saw an explosive 98% growth in GMV YoY. Facebook remains king on the social commerce scene with the largest percentage of Cyber Week social commerce sales.

3. Channels fit for every shopper, every day.

Based on this year’s results, we found that Fashion and Jewelry and Sports and Outdoors were the top categories on Facebook and Instagram, whereas Health and Beauty performed best on Amazon.

We also found that Cyber Monday was the strongest day for Amazon sales, while more customers shopped on Facebook and Instagram during Black Friday. Additionally, it came as no surprise that small-business geared marketplace Etsy saw its peak sales on Small Business Saturday as more customers shopped small.

BigCommerce VP of Revenue Growth and GM Omnichannel, Sharon Gee, shares her thoughts on Cyber Week omnichannel growth:

Alternative Payment Methods Grew in Popularity

1. Customers want to Buy Now, Pay Later.

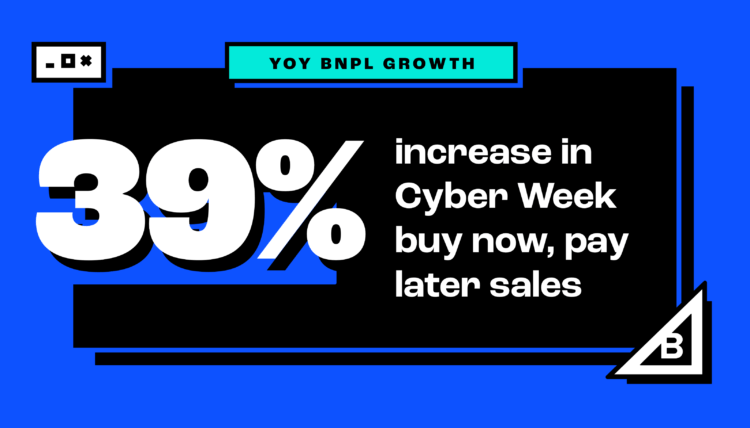

As one of the top projected ecommerce trends for 2022, it’s no surprise top buy now, pay later (BNPL) solutions grew 39% YoY in GMV during Cyber Week.

BNPL payment options have the potential to help increase AOV by offering customers more flexibility for large purchases. The top BNPL AOV partner had triple the AOV of the next-closest gateway.

2. One-click checkout sales surge.

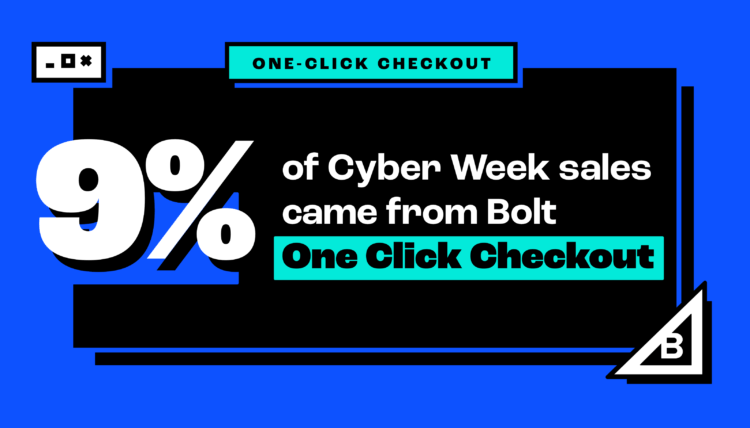

BigCommerce partner Bolt One Click checkout accounted for 9% of overall sales. Customers also spent more per order when using one-click checkout, as evidenced by Bolt’s average order value coming in above the Cyber Week average and more than doubling YoY.

Customers are clearly gravitating to the convenience of a one-click checkout option, as fewer clicks equal less friction.

3. PayPal holds its payment power.

Customers continue to place more Cyber Week orders with PayPal, which accounted for the largest share of total orders.

For yet another year, PayPal continues to hold consumer preference. With its portfolio of alternative payment options, customers are finding the flexibility they seek across Digital Wallets, Venmo, PayPal Pay Later (Pay in 4) and more.

Top-Selling Categories by Sales

1. Customers are still purchasing pandemic favorites.

Heading into the holiday season, it was unknown if 2020’s shift in purchasing decisions would continue to impact buying behaviors.

The result: Pandemic favorites are still most popular among consumers. Sporting Goods continued to claim the top spot in GMV across same stores, while also benefiting from an 8% GMV increase YoY.

Fashion and Jewelry remained the next most popular category, followed by Top 3 newcomer Health and Beauty.

2. More customers bought Health and Beauty products during Cyber Week.

This Cyber Week, Health and Beauty products were the rising star. With more customers returning to work and social gatherings, it comes as no surprise that the category saw an increase in popularity.

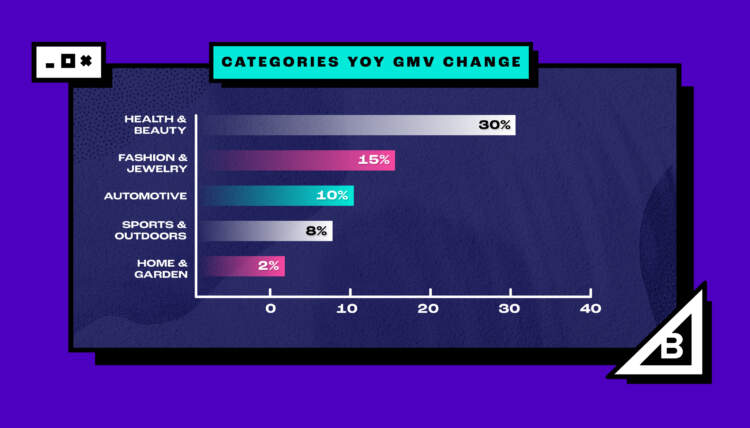

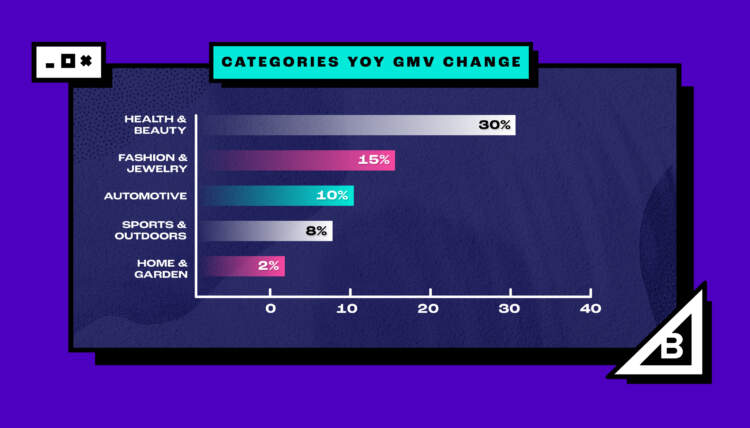

When analyzing BigCommerce’s same-store data YoY, Health and Beauty products outpaced the competition with a steep 30% YoY gain in GMV across Cyber Week. Specifically, Black Friday was the top day for Health and Beauty purchases. Following Health and Beauty were Fashion and Jewelry (+16% in GMV YoY) and Automotive (+10% in GMV YoY).

Customers are also spending less on Toys and Games during Cyber Week, as the category saw the sharpest decline in YoY GMV growth coming in at a -21% loss.

3. Wedding sales are on the rise.

Following the ripple effect of pandemic wedding delays, 2022 is predicted to see 2.47 million weddings — double that of 2020. Unsurprisingly more customers were making wedding-related purchases this Cyber Week. Across all BigCommerce merchants, Wedding and Bridal merchants saw a 49% spike in GMV YoY.

Travel sales took a steep -76% YoY dip in GMV, showing that customers may not quite be ready to travel again.

Cyber Week Gained International Ground

While Cyber Week remains a predominantly U.S. holiday, we continued to see a boost in many countries joining the Cyber Weekend tradition. Here are the top ten countries by GMV:

- Australia

- United Kingdom

- Canada

- New Zealand

- Ireland

- Germany

- Hong Kong

- China

- South Africa

- Egypt

1. Asia-Pacific outpaced other regions.

Asia-Pacific (APAC) made significant strides during Cyber Week with the largest regional growth in GMV (+40% YoY) and orders (+42% YoY).

Health and Beauty and Fashion and Jewelry were the most popular categories among APAC consumers. While Fashion and Jewelry was noticeably the most popular category in EMEA, the region saw far fewer sales in Health and Beauty, but more sales in Automotive and Home and Garden than APAC.

2. Black Friday was the most popular international Cyber Week shopping day.

In contrast to U.S. results, more international sales were made on Black Friday than any other day of Cyber Week.

Australia saw the largest number of Cyber Week sales each day aside from Black Friday, during which The United Kingdom took the number one international spot.

3. Latin America stands out from the crowd.

The Latin American (LATAM) region continues to show ecommerce growth potential — with Latin American countries demonstrating a 17% increase in Cyber Week orders YoY.

Cyber Week sales in El Salvador saw the largest GMV growth by country at an astonishing 400X over the previous year. Other Latin American countries with standout growth included Argentina and Brazil.

Looking Ahead

As evidenced by the 2021 holiday shopping season to date, it’s clear that ecommerce growth is continuing its upward trend. With U.S. online sales expected to reach $1 trillion in 2022, retailers should continue investing in ecommerce in order to meet customers where they are.

Merchants can get ahead for the remainder of the 2021 holiday season and heading into 2022 by executing on these strategies.

1. Ramp up for returns.

With more holiday orders, merchants should brace for more holiday returns. Although often overlooked, the post-purchase experience — including returns — is a key component of providing a seamless overall customer experience. Having a flexible return policy or extended return period in place can make or break the end-to-end experience for customers this holiday season.

2. Continue to offer out-of-stock alternatives.

As of October, Adobe reported out-of-stock messages had risen by 172% compared to the pre-pandemic period, and will likely hit harder following the holiday rush. For delayed merchandise, offering gift cards, enabling back-in-stock notifications and allowing pre-orders are a few ways retailers can get ahead of supply chain delays.

3. Expect last-minute shoppers to Buy Online, Pickup in Store.

With current shipping deadlines coming soon, expect last-minute shoppers to be in a bind. According to Adobe, click-and-collect orders surged to 32.1% of ecommerce orders during the week of Christmas in 2020, up from 19.4% the prior week. Merchants should expect curbside pickup and buy online, pickup in store (BOPIS) to spike as we count down the days to December 25.

4. Embrace the Buy Now, Pay Later boom.

Top BNPL payment gateways saw 39% growth in GMV on BigCommerce during Cyber Week. Offering flexible financing options is just one way to reduce friction at checkout — plus, one of the benefits of offering BNPL solutions is their potential to also drive higher AOV. With nearly 3 in 10 digital buyers predicted to use BNPL as a payment option in 2022, the time to offer buy now, pay later is now.

5. Start tapping into social commerce.

If you learned one thing from Cyber Week 2021, it’s that social commerce is on the rise. eMarketer reports that US social commerce sales will rise by nearly 25% in 2022. With more consumers discovering products online, meeting your customers where they’re scrolling is more important than ever. Merchants can take advantage of BigCommerce’s integrations with Facebook, Instagram and TikTok and start selling on social media.

6. Loyalty, loyalty, loyalty.

With out-of-stock surprises forcing customers to abandon brand loyalty this season, keeping customers coming back will be more important than ever. Be sure to offer perks and rewards for holiday purchases, and capitalize on the influx of data insights to learn more about how to connect and build long-term brand loyalty with your customers.

Summary

Cyber Week 2021 is behind us, but its results have clear implications for the future of ecommerce. The continued rise in ecommerce and shifts in shopping habits as seen over the past week will likely persist in 2022, and BigCommerce remains an industry-leading platform with the functionality and flexibility equipped to meet merchants’ ever-changing business needs.

BigCommerce is here to support merchants through the remainder of the holiday season and heading into 2022. For last-minute holiday tips and tactics, be sure to check out the BigCommerce 2021 Guide to Holiday Planning.

To gain even more Cyber Week and holiday insights, tune in to our upcoming episode of the Make it Big Podcast, where we’ll dive deeper into industry trends, customer examples and more.